Olympique Marseille v Borussia Dortmund - Draw at 3.45 - Over 2.5 is slight value at 2.34.

Valencia v Chelsea - Match Odds prices are almost exactly the same as mine. Over 2.5 is value at 2.2.

Thanks to all those who have shown interest in the XX Draw selections. I have put together a five page sales pitch, I mean 'prospectus', for your reading pleasure, and thanks to those who very generously used the Donate button - at least now I know it works! Seriously, it is appreciated, as is the comment from Mark who wrote:

What is a key element to facilitating long term profit, is touched upon with the FACT that .05-.1 are big ticks and an element of patience can become your biggest ally in beating the odds. Again though, if an edge is to be gotten through self creation, long live the impatient. The blog continues to deliver quality post after post Cassini.

Thanks also to Spad who informed me that the FTS Forum is indeed available to me.

Griff posted his EPL draw picks for this week, and they are Bolton v Chelsea and Fulham v QPR. Chelsea have a game to play, so I can't enter their rating in yet, but Fulham v QPR appears to be a "No Bet" for me. I have Fulham at 2.14 so slight value on the lay, but not enough to qualify as a value selection. Having drawn five games in a row, I can see the appeal of Fulham drawing another one, especially as it is a local derby.

I was wondering why my hit count had dramatically increased lately (1400+ hits over the last two days) and in part, it was because of my recent post called Make Or Take aka "Can't Be Arsed", which appears to have been linked to on the FTS forum, frequented by a number of "Lay The Draw" aficionados. Despite being only two days old, the post is already in my top ten all-time. Unfortunately I can't read the comments over there as I am not a member, but it would be interesting to know what the general feeling was about my post. I can be a little provocative at times - just ask my sisters!

In contrast to the XX Draw selections, the Value selections had a poor weekend, dropping 13.78 points from 69 bets. La Liga was the worst of the leagues with more than half the points being lost here, (I'm beginning to hate La Liga) while Serie A was the best, up a miserly 1.04 points. There are clearly a few wrinkles still to work out with these selections, for a start 69 bets is far too many, and for the third round in a row, not a single Under 2.5 goals selection was found in France, while in Germany, when value is found, which is less often than France, it is currently always on the Under 2.5 goals. I'm also suspecting that the system may work better in the more competitive leagues rather than in La Liga and the EPL where the top two and top three teams respectively are almost certain before the season starts. France right now has five teams within two points of the lead and Italy, albeit after only four rounds, currently has no less than eight teams within one point of the lead! The Paris St Germain experiment could turn Le Ligue into a similarly boring one, but Olympique Lyonnais have been punching above their weight for a while, so perhaps not.

Six European games between rated teams this week, with the first games tonight. I see little value in the Bayern Munich v Manchester City match, with my prices close to the market's, although Under 2.5 goals is value at 2.16 versus my 1.88. Napoli (v Villareal) are a value lay at 1.75 (I have them at 2.0) and again, Unders is slight value at 1.85 (my odds are 1.69). As usual with these European games, there is little data to go on, so don't be putting your mortgage on any of them.

Now back to draws, and Griff stopped by to say:

Just wanted to give you a update on my own draw system. It's just based on the EPL so far this season: Strike rate 56.25% ROI 97.31%, and the back test over the past 3 seaons including also this season so far: Total matches 301, Strike Rate 36.88%, ROI: 31.37%.

Not too shabby. From January, when I first started recording the prices for these selections, the numbers for me are currently:

Since tracking the results of these selections, and assuming an average price based on the numbers for each league since 2011 (rounding down, but close enough for these purposes) my numbers are:

An ROI of 31.7% after 300+ matches is quite remarkable. I have a couple of questions: 1) Are all your selections from the EPL? 2) What was your longest losing sequence? 3) Are your returns to level stakes? 4) What prices are you using?

Sadly, the idea that people would be happy to donate after a weekend of winning selections is apparently a non-starter, as I suspected it might be. Worth a try, but I think that if people aren't delighted enough after a weekend of four winning draws from five selections, (with only a 90th minute goal coming in the way of a 500-1 accumulator), to make a donation, then the idea is clearly doomed. If anyone wishes to receive these on a subscription basis, and I am told there are a few of you out there, please send me an e-mail: calciocassini @ aol.com It'll likely be a while before we do as well again as this past weekend though!

There was an interesting article on Yahoo’s Finance pages yesterday, about how birth order affects you, although I have no idea what ‘noogies’ are. For the record I am a first-born, with two younger sisters (although in the past few years, I have started to lie about my age and deduct 10 years, meaning that I am now the last born). My choice of career still fits, as according to the article, first-borns, last-borns and even only children all tend towards information technology and my newly acquired last-born status would explain my enjoyment of writing. Fortunately, my change did not affect my IQ, which remains significantly higher than that of both my sisters - combined.

The article did get me thinking about how many traders are first-born, last-born, only children etc., so another poll appears. Feel free to participate.

How Birth Order Can Affect Your Job, Salary

It's just not fair: Middle children are in a bad spot

Not only did your big brother steal your Halloween candy throughout childhood, but as an adult he probably makes more money than you, too, say recently released survey findings.

As if years of retribution-free noogies weren't sweet enough, it turns out that first-born kids are the most likely to earn six figures and hold a top executive position among workers with siblings, according to findings from jobs website CareerBuilder.com.

Meanwhile, middle kids are the most likely to report holding an entry-level spot and earning less than $35,000, while siblings born last are the most likely to work in middle management.

"The first-born child is usually in a leadership role in the household and it continues into their career," said Michael Erwin, senior career adviser at CareerBuilder.com. "The middle child tends to be more of the peacekeeper. The last born is more of the free spirit."

The CareerBuilder.com survey was conducted online between May 18 and June 8 among 5,708 full-time workers. Results also indicate that only children are more likely to earn six figures and to be a top executive, while workers with siblings are more likely to have job satisfaction.

"You know how to work better with a team because you've had siblings. An only child is used to doing things on their own," Erwin said.

According to the CareerBuilder.com survey, depending on order of birth, individuals tend to be in certain types of work. Those who are born first usually go into the fields of government, information technology, engineering and science. Middle children often go into law enforcement, firefighting, construction, education, and personal care. Those born last frequently go into art/design/architecture, editing/writing, information technology and sales.

Only children tend toward information technology, engineering, nursing and law enforcement.

Life Is Unfair

Firstborns, before their siblings arrive, benefit from more parental investment, such as time spent talking.

"When a sibling comes along, one has a rival for that attention and one is going to experience an intellectual environment that is being diluted," said Frank Sulloway, an adjunct professor in the psychology department at the University of California, Berkeley.

Research indicates that earlier-born men and women have higher educational attainment and higher earnings. On average, the IQs of firstborns are about three points higher than second-borns, based on data for men, according to Sandra Black, an economics professor at the University of Texas, Austin. Just a few IQ points can have an outsized impact.

"These are relatively modest differences, but that's sometimes the difference between getting into Harvard or some other school, and who gets a better job. It's totally unfair, but that's the way it is," Sulloway said.

Small differences among different siblings can also mean that there are a disproportionate number of firstborns in challenging fields such as medicine and law, he said.

When it comes to annual earnings for men, firstborns earn about 1.2% more than second children, and about 2.8% more than third children, according to Black. For women, firstborns earn about 4.2% more than second-borns, and about 6.6% more than third-borns.

For earnings, much of the difference due to birth order is explained by differences in educational attainment, Black said.

"Birth order affects educational attainment, which then affects earnings," Black said. "Later-borns earn less than firstborns, and a substantial part of this different is due to the fact that later-borns get fewer years of education."

However, not all is doom and gloom for those who aren't the first-born child.

"Earnings are determined by a lot of different factors. So later-borns should not give up," Black said.

Birth Order and Personality

Birth order is not decisive when it comes to an individual's life achievements, but personality is shaped by experiences, and individuals have different experiences due to birth order, said Ben Dattner, a NY-based organizational psychologist.

"First-born siblings have an incentive to adapt to the family environment they were born into. There's a niche in the family for the first-born sibling to be a culture carrier — an open slot for the position of good-family citizen," Dattner said. "Second-born children are born into a family in which somebody has already occupied the position of good student, good kid, carrier of a parent's values."

Younger siblings will try to find their own niche — an area that firstborns don't already excel in, Sulloway said.

"To be different, younger siblings will often try to find their own domain, something they are particularly good at, something that is different from an older sibling's area of expertise," Sulloway said.

Later-born children tend to be more interested in foreign cultures and travel, and may be more likely to take risks, experts said.

"First-born siblings are less likely to move far away from their parents because they have adapted into their family's culture. But there are exceptions to every rule," Dattner said.

Who winds up drawing the shortest stick? It's the middle kid who tends to get less attention than either firstborns or younger siblings.

"Firstborns tend to receive more attention because they arrive first and receive 100% of parental attention until another sibling arrives. In addition, firstborns are older than their other siblings, generally assume a leadership role, and often serve as surrogate parents, assisting parents with child-rearing tasks, for which they derive certain rewards," Sulloway said. "Lastborns tend to receive an undue share of parental attention because they are the most vulnerable sibling, and hence the most in need of continuing parental investment and care."

The XX Draws are back in form, winning 4 of 5 this weekend, except that of course, 'form' has nothing to do with it. Randomness contain no patterns, though to less sophisticated investors than readers of this blog, random events may sometimes appear to have a pattern to them.

At an average price of close to 3.5, a strike rate of 37% is pleasing. We have no control over whether the winners come in bunches or evenly spaced, but it shouldn't matter so long as they keep coming.

Peter Nordsted's Drawmaster picks had a great weekend too, finding two winners from three EPL matches, helped by a 90'+ own goal at Queens Park Rangers today. One could do a lot worse than combine these draw selections.

I came across this example of a (not so) sharp mind on the Betfair forum today. A customer for at least two years, he posted:

I just want your insight on something that looks quite attractive to me in terms of betting over the long-term. What are your views on the following?

If I start with an initial bet of USD 100 and place ONLY one single bet (mostly live) at the odds of 1.10 today and bet with the winnings of USD 110 tomorrow and so on and so forth DAILY, choosing a SINGLE BET at the same odds of 1.10, over 80 days, should all of them win, it will win around USD 200,000.

Does that look too far-fetched?

I know that the key here is DISCIPLINE as well as LUCK!

But what’s the probability of the 1.10 odds not winning, barring the recent shocking performances by Real and Barca?

And yes, I’m not confining myself to football only. The bets can be placed on tennis, basketball, baseball etc.

Views as well as feedback from past experience most welcome!

An amazing idea, and the only surprise is that no one has thought of this before. I loved the line "But what’s the probability of the 1.10 odds not winning barring...". This basic misunderstanding of probability from Betfair users who have clearly not learned much during their apprenticeship is a great example for why we should be putting poor value bets out there! Somehow, our friend believes that his bets at 1.1 will defy the odds and never lose. Barring the recent shocking performances by Real and Barca, which of course, can never happen again.

The "Lay The Draw", aka "The Cash Generator" system continues to come to the fore every few weeks. I'm all for it. The more people laying the draw, the better the prices available for those who prefer to back that outcome. "Lay The Draw" doesn't work of course, although I shouldn't say that. Proponents state that although there are fundamental flaws with the system, if you pick the correct matches, it's a winning system. Except that you can't "pick the correct matches", and that flawed logic applies to any system.

Goalless matches can't be predicted, or why not simply lay the 0-0? Other problems - the web site goes down. The outsider scores first and the draw price doesn't move out before the favourite equalises. Or the equaliser is scored immediately after the 'bet winning' goal leaving you back where you started, but it's fun to read. I think it is so popular because it sounds so simple, and anyone can get lucky in the short term with it.

Hard to believe that people still pay money for this system though, but anyway, while reading another thread on the subject on the Betfair forum, someone posted this line

I would be willing to bet that at least 90 percent of people on Betfair just take whatever's up there, they can't be arsed to wait for a bet to be matched.

It raises a key point, because whether you are a maker or a taker of prices can make a big difference to the bottom line, especially when it comes to the draw where a tick isn't .01 but at least .05 (end of season Italian games excepted of course). Getting 3.45 rather than 3.4 or 4.1 rather than 4 is huge, and if you can put your bets up early enough, more often than not they will get matched by people "who can't be arsed to wait".

Those ticks add up. It also pays to be a maker in illiquid markets. There may be a gap of several ticks between the back and the lay sides, but of yours is the best available, it will often get matched. If true value is in the middle of the spread, you are in good shape if you are able to get matched on the right side. My single biggest win came after I entered a lay bet of several thousand at a poor (in my opinion) 1.03 and was somewhat astonished to see it all taken in one bet. Would that money have come in as an ask at 1.03? It's possible, but somehow I doubt it. Someone saw the money there, greed kicked in, and they took the plunge. It's often easier to make your own edge than it is to take an edge.

And taking that logic a step further, feel free to try out the new Donate button. It was suggested to me that if people are willing to pay for selections, but I'm not totally comfortable with that idea, at least for now, that people may be happy to donate after, for example, winning on some XX Draw selections. I'm not convinced, but it'll be an interesting experiment.

The 90' goal put in two appearances today in my XX Draw selections, in Mainz and later in Valenciennes. A key match which came up on three radars, Mainz v Borussia Dortmund was a Recommended Bet from Football Elite - with the DNB (Draw No Bet) - and this match came up on the radar as an XX Draw selection, while the Value System also suggested a lay of Borussia Dortmund. Typical then, that Dortmund scored a 90' winner, and all three systems showed a loss on that game.

There was better news from Bavaria, where newly promoted Augsburg held Hannover '96 to a draw, (we finally had an XX Draw winner from outside of England and France), and then the late game between Valenciennes and Olympique Marseille where the home side trailed until the 92' before equalising. Some go for you, some against you, but two winners from three today, and indeed four from the last seven, have improved the ROI to 16.21%. Perhaps I should just stick to France, where the ROI is 120.6%!

Overall, respectable enough, but Pete Nordsted's Drawmaster had two picks today, Wigan Athletic v Tottenham Hotspur (1-2) and Stoke City v Manchester United (1-1) with the latter win lifting his ROI to an even more impressive 37.5%.

Updates on the value bets once the weekend is complete.

This article from This Is Money.co.uk reveals that the number of active customers on Betfair is down 19 per cent to 381,000. It's not clear [to me anyway] when this decline is measured from, or what the definition of 'active customers' is, or over what period that 381,000 is measured over (I suspect a quarter), but if it is prior to the introduction of the PC3 [latest Premium Charge], then there is surely worse news to come.

The news that Betfair founder and chairman Edward Wray could be the next senior manager to leave the embattled online gambling firm, will be met with raised eyebrows among investors.

The FTSE 250 business, which allows gamblers to bet against each other rather than against a traditional bookmaker, is already looking for a new chief executive after David Yu said in June he would move on when a successor is found.

But at yesterday’s annual meeting Wray, a former JP Morgan trader who co-founded the business ten years ago, said the firm had ‘started the search for a deputy chairman. The intention is for this person to take over from me as chairman at an appropriate time in the future’. This follows a spate of other senior executives who have also left the business in recent months.

And while all this has gone on investors have seen Betfair’s stock almost halve since it floated last October at £13, with a value of £1.3billion. Betfair yesterday closed down 60p at 723p, valuing it at £839million. The business has faced a number of disappointments and delays as it has tried to push its services into a host of European countries, such as Germany, Denmark, Italy and Spain.

And in August the UK government revealed online gaming companies based offshore would need a domestic licence to take bets from British customers. Betfair moved its headquarters to Gibraltar in March to save around £20million a year.

These constraints on growth are beginning to affect the business, at the start of this month the firm turned in first-quarter core sales down 7pc to £80.8million, with the number of active customers down 19 per cent to 381,000.

For Betfair the wider economic climate is tough, and the regulatory issues it faces are protracted. Investors will want to see a settled management quickly in place, who can then set about getting the share price moving in the right direction again.

It doesn't help that the site continues to have problems. As Peter Webb writes:

Of course you also have Betdaq that you can trade on. The liquidity on Betdaq is higher than ever at the moment and strategies that I use on one exchange tend to transplant well to the other. So whether you use Betdaq to hedge or trade outright its more viable than ever nowadays.

The Guardian had a couple of scathing articles relating to Betfair yesterday. Betfair's losing streak:

Barely a week seems to pass without somebody senior at Betfair announcing they're off. Yesterday it was Edward Wray, chairman, founder and 11% shareholder. He told the annual meeting that he, too, is preparing his exit, apparently because the company wants to tick every box in the handbook of good corporate governance.

Wray's departure will take a while – a successor will have to be recruited and serve a short apprenticeship as deputy chairman. Even so, it's a significant addition to a long list of departures announced since flotation less than a year ago.

The tally includes chief executive David Yu (going once a recruit can be found: the search is three months' old) and Mathias Entenmann, chief product and services officer, who was flagged up in the prospectus as another key employee.

Then there's Charlie Palmer, head of mobile; Robin Osmond, chief executive of financial betting exchange LMAX; Matt Carter, director of research; Lee Cowles, director of UK sports and gaming; and Andrew Twaits, chief executive of the Australian operation.

Investors, pondering a share price 40% below its float level, may remember the third of the four reasons given for going public. A listing would "assist in the incentivisation and retention of key management and employees".

Yeah, right. To judge by yesterday's meeting, public life seems instead to have created a bunker mentality among Betfair survivors – rarely a good sign.

And Bounced from Betfair's annual meeting

Whether Betfair's annual meeting on Thursday was a drama or a comedy is a moot point. Either way, the venue – the headquarters of the British Academy of Film and Television Arts – could hardly have been more appropriate.

The backdrop for this latest Bafta performance had been developing for months, following the betting exchange's stock market flotation last October. Since then, the board has worked tirelessly to craft a £770m gambling group from a £1.4bn start.

Has chairman Ed Wray become a tad over-sensitive when reminded of that feat? Very possibly. On Thursday, Wray banned the media from the company's inaugural annual meeting as a public company – a move almost unheard of in the 21st century.

Just to be safe, he barred journalists who happened to be shareholders, too. Admittedly, the Guardian is neither a large nor a long-standing investor, having acquired its five shares on Monday precisely in order to dodge the media ban. The company's registrar liaised with our chosen broker and we received a proxy voting form alongside a letter confirming that we would be able to attend.

Betfair, however, had other ideas. Apparently, we had the "wrong type of form" or the one that we did have was filed too late.

Then followed a series of unorthodox excuses: "It is not the job of the Guardian to doorstep AGMs," said one PR. "We don't make the rules," said another, (er, yes, you do), while Betfair's legal supremo, Martin Cruddace, offered that the meeting was solely for shareholders (excuse me!).

His flunkies blocked journalists from accessing the auditorium – with one of the enforcers being a sheepish-looking former Sunday Times city editor, Paul "Doorman" Durman.

So what did the company have to hide? "Absolutely nothing," says Wray.

Betfair has missed numerous financial targets and seen its shares plummet, while chief executive David Yu and finance director Stephen Morana have been handed total pay rises of 125% and 445% respectively. Those windfalls – in effect doled out as a reward for getting the inflated flotation away – were trousered despite objections from governance groups including the Association of British Insurers and Pirc. A string of top executives and managers have quit or are leaving the group – and chairman Wray said on Thursday that he too would soon be stepping aside to spend more time with his millions.

Will he be missed? The poll at the annual meeting suggests not. Only 47% of the company's shares were voted in favour of his re-election, and 17% actively refused to support the co-founder. The news of another planned Betfair departure knocked the shares again, as they lost about 8% to 723p – 44% below the £13 flotation price.

All of which may have gone unnoticed by non-executive directors Josh Hannah and Ian Dyson, who were notably absent from their chairman's side. Were they barred, too?

A far cry from the esteem in which they were held by almost everyone who wasn't a rival bookmaker just a few years ago.

Ed Wray, one of the founding fathers of Betfair, announced at Betfair's AGM yesterday that he is stepping down as Company Chairman. Scott Ferguson formerly worked for Betfair, and had this to say about his time there:

It was all about working for Ed and Bert, and their dream. A dream that turned into something huge, and naturally, as it became a big corporate entity the fun slowly disappeared. It was no longer building someone's dream with an ethos of being the punter's best mate but turning into a soulless place desperate to float and with its heart set on screwing punters for every penny they can get.

Those comments certainly reflect the opinion of many, as the company has gone from being almost beloved by many to an, albeit necessary, evil empire in just a few years.

After reeling off a list of names of recent Betfair executives heading for the exit - CEO David Yu; chief product and services officer Mathias Entemann; head of mobile Charlie Palmer; director of architecture, research and prototyping Matt Carter; director of UK sports and gaming Lee Cowles; director of European and public affairs Tim Phillips; CEO of LMAX (Betfair’s troubled financial betting exchange spin-off) Robin Osmond; and CEO of Betfair Australia, Andrew Twaits - Peter Amsel amusingly asks

Is it bad form to remind shareholders that one of the company’s key rationales for going public was that doing so would “assist in the incentivization and retention of key management and employees?”

Interesting that all media were barred from the meeting too.

On to more important matters now, and we have five XX Draw selections for this weekend. They are:

And finally, after about nine years, the film version of Michael Lewis's excellent book Moneyball has finally been released to good reviews in the US. Not out in the UK until November 25th, but who waits for official release dates these days? And your significant other will likely be up for watching it with you, since it stars Brad Pitt, who incidentally also owns the film rights to Lewis's book "The Big Short: Inside The Doomsday Machine", which actually makes the financial crisis of 2007 understandable. That's recommended reading too, if I've not mentioned it before - a lesson in holding a position that evidence tells you is value, and opposing a stubborn market.

Does nobody study my spreadsheets? An audit of my XX Draw results uncovered a serious discrepancy, which cost me six point in profits, yet nobody noticed! The error has been corrected in the latest update, which combined with the two losers in Italy last night, drops the ROI on the season to just 4.83%. Not too shabby after a few hundred bets perhaps, but after just 30, nothing to write home about. Not that there would be any point, because hardly anyone in my family understands anything I write about in this blog. My son does, and possibly a nephew, but that's about it. A few games tonight, but a summary of midweek so far appears to be a loss in France (Bonnie Tyler anyone?), a matching profit in Italy, and a small profit in Spain. I'll update the final totals after tonight's games, and publish them, but for now these are close enough:

With over 300 bets already this season, it won't be too long before I have over 1,000 bets, and the ROI will start to be meaningful. Right now, it's up and down like a whore's drawers, but as George said in a comment on Monday,

"If you can support a 5% ROI edge over 1500+ bets, you are sitting on a gold mine, my friend..."

My own gold mine would be nice, but while there's a long way to go I suspect, the 'prospect' is exciting.

To address some of the other points raised by George, here are his comments:

Very useful to see your season-to-date stats. Lots of blogs focus only on the latest round of matches. Signal/Noise is so low that even a decent edge (pos or neg) is not obvious unless you have a large number of bets to study (250 is my rule of thumb). In your season-to-date stats, assuming zero edge, your results are 82nd percentile. Can't make it into an academic journal article, but practically very very good. What do your 10/11 season stats look like?

The value system only started late in the season for 2010-11, a trial in the EPL to iron out any spreadsheet issues, and while they were very profitable (Match Odds +12.9 from 26 bets. Over/Under +7.75 from 14 bets) I'm not going to include them in the running totals. Far too small a sample. George's second comment:

At what point in time and over how many bookmakers do you select the odds that go into your records? I have a bit of a problem with FE on this issue. If the target is good replication of the tipped bets, then a tipster (I am not saying you are one) should limit himself/herself to 4-5 big-limit, big-payback bookies (perhaps review them annually). Otherwise, there is a bias there, which in reality wipes out a significant part of the perceived/reported edge. Or one can simply report different edges for different contexts e.g. early-market (low-limit) edge, pinnacle-only edge etc. By edge, I always mean ROI%.

There is nothing sophisticated about the odds I enter - quite simply they are those that are readily available on Betfair. (Occasionally if the spread is 2.12 - 2.18, I will enter 2.15, if it is 2.12 - 2.14, I use the 2.12 as the back price although I will look for the 2.14 when I place my bet). I use the Betfair prices for two reasons - 1) Since a number of selections are Lay bets, this obviously limits my options to the exchanges and while occasionally BETDAQ may be a tick higher, it's not often and 2) I have no problem getting my bets accepted on Betfair whereas bookies would be a different matter. The prices entered are those at the time I happen to pull them, usually a couple of days before the matches, but occasionally closer to kick-off, for example weeks like this one where there are midweek games. For the Over / Under markets, prices can be a little soft if I try to pull them too early. George (the Third):

Why are you not looking at the Asian Handicap markets? As far as I am concerned, if there is liquidity there, I will dig for an edge. Asian handicaps is where the liquidity is. I think I saw something from you about the mismatch of incentives of teams on spread/handicap markets, which you don't like. Don't see how that's relevant. If your system finds value, then obviously it overcomes the incentives problem. If one cannot find value, then yes, the funny incentives could be used as a reason for not digging further, I guess.

I do not find much liquidity in the Asian Handicap markets, at least not those on Betfair or BETDAQ. This is primarily an academic exercise right now. If an edge appears to be there in a few weeks, I will reassess, but right now I'm not looking at running before I can walk. Appreciate the comments George. And then there was a comment from my NFL Chat-room friend Average Guy, who asks

Hi Cassini, does your stake vary with the calculated value. If the value % is higher is the stake higher ?

Right now I'm just backing (or laying) the value selections (10% edge or more) for a small flat stake, but after a few weeks, I'll look at whether I would be more profitable adopting a Kelly style approach to my staking. Clearly the number of value bets I am finding is too many, but it's a useful 'churn' to offset the Premium Charge, which incidentally hit me again yesterday. It shouldn't be a problem next week though - this week hasn't been a good one so far, and just makes the charge that much more annoying. Had the losses of this week happened a few days earlier, then I wouldn't have had to pay the charge at all, yet just because an arbitrary line is drawn on a Sunday night, and I won before the line, and lost after it, I have to pay. As I wrote earlier in the week, betting isn't like that. Wins and losses are not evenly spaced. Oh well, whining about it doesn't seem to do any good, so I shall shut up.

It’s typical of betting really, that after a cold spell of 16 XX Draws without a winner, we then hit two in a row, and we have two more selections tonight. Bordeaux v Lille finished 1-1; a winner at 3.35, and anyone laying Bordeaux at 2.98 made a little extra as well. France continues to be weird. For the second round of matches in a row, the Over 2.5 is value everywhere - well almost. In 8 of the remaining midweek games the Over is value, while yet again, a value selection is found in every single Match Odds market. My expectations of goals are clearly more than the market's, but it worked out for the best at the weekend, and this game (investing, not French football), is all about differences of opinion, and my opinion is based on the statistics.

A profitable outcome in Italy too, where my concerns about the accuracy of Novara’s rating were dispelled as they beat a very poor Internazionale team whose rating is in rapid decline. An example of how easy it is to ignore the numbers, and be led astray by the names. Only two seasons ago, Novara was playing at the third level of Italian football, while Inter were dominating Serie A.

In the remaining midweek games in Italy, the spreadsheet suggests the following bets are value:

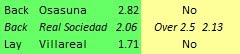

Not quite so good in Spain again, with Osasuna failing to win at 2.82, and the lay of Villareal (1.7) going down. Real Sociedad were our one winner in La Liga, beating Granada by 1-0 – only two goals more needed for the Over 2.5 goals to be a winner! Here are the rest of tonight's selections:

The two XX Draw selections are posted at Gold All Over together with the latest update.

* Coincidentally, an interesting article on la différence in today's Telegraph. Bonne chance.

From Sports Book Review:

A BetGoTo (SBR rating D-) player has written SBR with a payment complaint. The player tells SBR that he has received some small payouts over the course of three years from the slow-pay sportsbook and casino group, but is currently waiting on approximately $2,700 since October of 2011.

October 2011? That doesn't seem too much of a delay by any measure. It does always create a bad impression when a company's web site has poor spelling or grammar, so perhaps I shouldn't be surprised.

A handful of games tonight, and the spreadsheet comes up with the following:

France: Bordeaux v Lille, XX Draw Selection at 3.35, or lay Bordeaux at 2.98, Over 2.5 at 2.25

Italy: Novara v Internazionale, Lay Internazionale at 1.69 (this one is risky given Novara being a newly promoted team with little reliable form to go on)

Spain: Osasuna v Sevilla, Back Osasuna at 2.82; Real Sociedad v Granada, Back Real Sociedad at 2.06, Over 2.5 at 2.13; Villareal v Mallorca, Lay Villareal at 1.7

Thanks to George for his comments on the last post, a record four, and Average Guy for his, well, average, one... I'll get to them when time permits, but with midweek games galore, I'd rather mess about with the spreadsheet than write blog posts. One (hopefully) pays the bills, the other doesn't.

Next time I notice an anomaly, perhaps I shouldn’t question it. A tres bon weekend in France, as the 10 value over selections produced no less than 7 winners, a profit of 7.29 points. The Match Odds selections didn’t fare quite so well with 'only' 5 winners from the 10 selections, but a profit of 1.74 points. Football Elite had two Recommended Bets here, Auxerre drew, but Toulouse came from 0-2 down to win 3-2 and a 90’ goal went in our favour for once.

I hope a few of you followed me in on the Overs, but a quick word on what 'value' means'. Take a look at Peter Webb's excellent recent post What does value look like? on this subject. Peter writes:

I’ll often make suggestions around value. In my football ratings I point to matches that will have above or below value median results. What I am trying to say is this looks value, that is value, this isn’t. But what does value look like?

One thing it is not, is a tip. I’ll liberally scatter the words ‘on average’ into many posts as that is what value looks like. All sports and most events show a great deal of variability and that means that it’s nigh on impossible to get things right all the time. Therefore when you see something from me, I’m not saying back or lay this item. I am saying there is value in that. To understand how value manifests itself over time take a look at the following chart (see below).

This chart represents a lay value strategy. I think I have an edge, in fact I am pretty certain I do based on my research, but this graph shows you how variable the results are. After nearly 500 events using £10 stakes I am up £400. But, as you can see, the road is bumpy and this is because value plays out over the very long term. In that mix you can get very long runs where it’s very positive or very negative, but over the long term you should see your bank produce higher lows during each draw-down. That’s how you know you are achieving value. Once you are certain, you start looking at how scalable the strategy is.

So when I make recommendations or give ratings, be sure to interpret it correctly. It’s easy when recommending something to look foolish, but that will only occur if you interpret the information incorrectly. What I am saying when I post up information is that, based upon my analysis, it looks value or look for value here. I know from experience that I can generally find it, but often the biggest hurdle to making it pay is commission and associated costs, that’s critically important as well. So don’t forget to focus on that as well!

It's an excellent post, which reinforces that the selections here are not tips. Value does not always win. It simply means that over time, you will come out ahead, although as Peter cautions, commission and expenses can make the difference between a profitable strategy and a losing one.

My results in England weren’t bad either, and again, it was the Under / Over selections here that outperformed the Match Odds with a profit of 9.88 points. Nine selections, nine winners. The Everton v Wigan Athletic game was the one match where I found no value, and the only Under bet was Aston Villa v Newcastle United, so again I benefited from plenty of goals. The ten Match Odds selections produced a profit of 3.66, much a boost to the season running total which is still overall down in the EPL. The totals for this week are in the screenshot below.

The highlight selection in Germany was the lay of Bayer Leverkusen at 1.46 who then proceeded to lose at home to Koln 1-4. My spreadsheet recommended a lay of Borussia Dortmund, and Football Elite had Hannover ’96, and with two late goals, we both came out ahead.

In Italy's Serie A, Football Elite found their third winner of the weekend as Atalanta beat Palermo. I had Atalanta priced at 1.96, the market at 2.44 so this was a huge value bet for me.

And finally, in my least favourite of the top five leagues, La Liga, my value lay of Barcelona didn’t quite pan out, as the hosts beat Osasuna by 8-0, but only a week before, Barcelona failed to win at 1.2 so a Lay Barca strategy is still ahead on the season.

My spreadsheet doesn’t handle extremes too well. Barcelona went off at around 1.11 I believe, and to come up with this as a price, I would have needed to estimate Barcelona’s goal scoring probability 100% higher and Osasuna's 50% lower to have been close to that. As a result, the value in games involving big favourites (Barcelona, Real Madrid, Manchester City, Manchester United, Chelsea in particular) are often off the scale, and result in Lay bets for these teams. Whether this proves to be profitable or not remains to be seen.

The XX Draw selections went 0 for 3 on Saturday, and 1 for 3 on Sunday, (at last a winner, and as these things tend to work out, it was at 4.1, the longest price of any selection this season). Peter Nordsted’s Drawmaster system found Aston Villa v Newcastle United, raising his ROI to 27.14% and taking the lead as mine heads south to 26.11%. P had a few comments about the XX Draws

Before Fulham's unlikely comeback to equalise against Man City and end the diabolical XX losing streak, there were 16 consecutive losers.

I was wondering how this streak ranks as far back as your draw records go.

This is the worst run since I started tracking the sequence of bets. I had a losing run of 8 back in Jan / Feb but these runs will happen.

If we assume average odds of 3.5, then the probability that any single match will NOT be a draw is about 0.71 (not factoring in your edge, which means that the probability is actually a bit less). The probability of 16 consecutive independent events with a probability of 0.71 is 0.00416997, or about 1 in 240.

It would be nice to have our winners evenly spaced, but betting isn't like that. That's why it is so important to understand what value means. I started the season with 7 wins from 10 selections, which was nice, but the losing run looks even worse as a result! The overall picture is pretty good. 7 wins from 27 selections doesn't sound like a great strike rate, but a level stakes 7.05 points profit, and an ROI of 26.11% tell the true story. It's also worth noticing that of the 16 losing selections, 5 were winners at the 80' point or later, and could have been traded for a decent profit.

Secondly, would you consider offering a paid service that would get subscribers your XX ratings as well as the match odds and over/under value ratings for each of the five major European leagues by Thursday or Friday of each week?

You kindly drip feed your loyal readers a bit each week, but without all of the selections, it is very difficult to fullow a system for a particular league and market category over the course of the season.

Of course I would consider offering a paid service. Consider the Pros: It's not something I am actively looking to do, but I do it for myself anyway, it takes up a lot of time, and if I could recoup some of hidden cost of that time investment, then why not?The Cons add up though, mainly with the added responsibility. It's one thing me losing my peanuts on my system, but it's something else dragging others down with me. There would also be pressure to get the results in and the selections out in a timely manner.

Finally, if you are doing ratings for match odds and goals for the five major European leagues, does that mean that you are placing 50-100 value bets per week?

That's a lot to monitor, especially if you are always trying to get slightly better odds on an exchange...

In a typical 'Round' of the big leagues, there are 49 matches, so potentially there are 98 value bets. This weekend there were a lot, 80 in total, but last weekend there were 'only' 56. These are selections where I think the edge is 10% or more. It is a lot to monitor, but it's a lot easier to monitor when things are going well than when you have a poor weekend!

Finally, Mark Iverson hosted another NFL chat-room yesterday for the Minnesota Vikings v Tampa bay Buccaneers game. This turned out to be an excellent with a big comeback from the Bucs who trailed 0-17 at HT after making just two First Downs. Minnesota (1.08 at this point) couldn't do a thing wrong, and the Bucs couldn't do a thing right, but in the second half, it was a different game as the Bucs rallied to win 24-20. I was all set to call it a day at half-time, and find another game to trade, but Mark talked me into seeing how the second half started, and hanging in was a good call. I know better than to think a game is over at 17-0, but what was unusual in this game was that until the second half, Tampa Bay hadn't shown any sign that they would be able to make a game of it, but the beauty of the NFL is that you just never know.

Something very strange is going on in France. Of the 10 Ligue 1 matches last weekend, I found value in just 4 matches (2 won, 2 lost) but the key point here is that my prices were close to the market's in 60% of the matches.

In the Over / Under category, I had just 3 value bets (2 won, 1 lost) and I was close to the market on the other 7 matches. So why is it that this weekend, I am finding value in every match? Both Match Odds and Over / Under markets?

Even stranger is that in every Over / Under market, my spreadsheet says the value is on the Overs in every match. Every one. This usually means one thing, and if it were anyone else I would definitely say it was, a mistake, but the other leagues have at least some games close to the market.

It makes me a little hesitant about putting these bets on though.

It hardly makes me appear the sophisticated value seeking punter when I back Overs 10 times, but since nobody is looking, what the hell. I'll chalk it up as anomaly for now, but it'll be interesting how the results play out, and it'll be interesting how my prices compare with the markets in the midweek games. I don't like midweek games. It means little time to get the data from one round of matches entered before the next round is upon me.

The XX Draws are having a poor run, the worst of 2011 anyway, with another loser last night in the Freiburg v Stuttgart game. I've posted the rest of this weekend's selections over at Gold All Over for anyone who is interested. The ROI on this season is down to 33.1% which is still excellent, and an increase on the second half of 2010-11, but losing runs can be wearying.

For my value bets this week, the top value Match Odds bets in each league are:

Lay Arsenal 1.95 @ Blackburn Rovers (Edge 35.5%), Back Auxerre 2.1 v Caen (34.6%), Lay Werder Bremen 2.68 @ Nuremberg (31.6%), Back Atalanta 2.44 v Palermo (24.5%); Lay Valencia 2.28 @ Gijon (45%).

Best Value Over / Under: Bolton v Norwich City Over 1.9, Nice v Ajaccio Over 2.72, Schalke '04 v Bayern Munich Under 2.53, Parma v Chievo Over 2.5, Real Zaragoza v Espanol Over 2.31.

Betfair Trading Challenge mentioned something that is worthy of further discussion. He writes, a little confusingly, but you can get the drift:

Take tonight's Europa league game, Stoke 1-0 up with 10 minutes to go. I fancied them to concede but when I looked at the price they were 1.3, to me that was not value and I would have ignored it.

The strange thing is that even though I thought 1.3 was too high a score I could not have backed them at that price. That's a bit paradoxical, is it not ? How can the lay be bad value and the back also be bad value ?

It may seem a paradox, because 1.3 should be either a value back or a value lay (unless the probability of the event is 0.7692 of course), but it's not. For a start, the in-play football markets are very accurate, making it nigh on impossible to find value after taking into account the commission. (In other words, if the Back / Lay prices are 1.3 / 1.31, the true probability is likely 0.7663 [1.305] so it's unlikely that you will find value on either side).

The only opportunities appear to be in the immediate aftermath of a game-changing event, e.g. a goal or a sending off, when there is some volatility, but in a sport like football, the prices will trend to 1.0 or 1000 depending on the time remaining, and many people have very accurate pricing models for this. I don't, and I suspect that most people don't, so while 1.3 may have been too long a price to lay, it may well have been too short a price to back as well.

I'm a little disappointed in the BBC, although they will no doubt blame the Press Association who provide their data. Manchester City shots on target v Napoli last night? 11, according to the BBC, trusted around the world, yet two other sites (Guardian Match Stats and 90thminute.com) both agreed that City had just 4 shots on target. So maybe a shot on target from one angle may not be on target from another, and a small difference on a slightly subjective statistic is perhaps understandable, but corners are not subjective. One is either awarded or it isn't, so how come the BBC have 8 corners awarded to Napoli, yet other sites have 9? It's as if someone watching the match dozed off, woke up a few minutes later, and simply made some numbers up. Do these people not realize that these numbers are important. I had to revisit the Chelsea v Bayer Leverkusen (did Bayer Leverkusen have 5 shots on target or 2? - there's a big difference) and Borussia Dortmund v Arsenal (Arsenal 6 shots or 2?) results and re-update the spreadsheet. For the league matches, I use Football Data, but for the UEFA competitions I have to look elsewhere. If anyone has any better, i.e. more accurate, sites as a source for these statistics, please let me know. I can't watch EVERY game!

Centre Court Trading is rapidly becoming one of my favourite reads with two great posts in the last two days. The latest titled Right-Brain Trading is quoting from a book by disgraced ** former trader, and author of Way Of The Turtle, Curtis Faith,

called "Trading From Your Gut". Leaving aside Mr. Faith's fall from grace, what he has to say here, paraphrased by CCT, is interesting:

The trading world is divided into two fairly distinct camps. The largest camp consists of traders who consider trading an art, those who are called discretionary traders. A smaller group consists of traders who use a specific set of rules to make their trading decisions. These traders are known as system traders.

....trading styles generally fall on a continuum between the purely intuitive discretionary trader and the purely rule-oriented system trader.

The best discretionary traders tend to be right-brain dominant, using their intuition to decide when to make trades....... They might describe their approach as having a “knack” for the market or a “feel” for the direction of the market.

..... purist right-brained traders.....often don’t understand exactly why they make certain trades; they just know when a trade feels right. This willingness to relinquish decision making to intuition or gut, characterizes the hard-core right-brain trader.

System traders.... use a rational, systematic process to decide when to make trades......don’t trade on their gut or intuition; they trade using rules and strategies. These traders often think in terms of signals and triggers.....Systems traders will have identified these specific criteria earlier, when they performed their backtesting and historical analyses.

I've touched on this subject before, and it's an interesting topic. If you are purely a system trader, you listen to your spreadsheet and lay Manchester City at 1.36 last night. If you are discretionary, you pile in against the Raiders at half-time because the price feels too short. I'm in two minds about what to make of this...

====================================================================

** "Randomness of markets is normal. Faith says to get out "if you can". He might as well be sitting at the craps table with that logic. It's the exact type of statement one would expect to hear from a person whose money management firm ended in a permanent CFTC ban. Caution should be taken when listening to this particular ex-Turtle."

Centre Court Trading had a post yesterday that many of us can probably identify with. He wrote that

...back in March, when I was going through those terrible dark ages, I attempted to change my strategy and be a little more proactive. It back-fired because I didn't fully commit to the change. I ended up not letting trades run long enough, cutting out early due to fear and didn't know what my plan was from game to game.

Probably the single biggest reason why most traders fail is that they cut their winners short and let the losers run, exactly the opposite of what they should do. CCT also said:

There were times yesterday where I was spotting opportunities but, as I've become inclined to do, ignored them as they were not quite as 'sure' as I would have liked. As you can guess, almost all of those opportunities would have produced green positions.

The US Open final was a classic example. I managed to catch Djokovic at around 1.8 after a few games and was convinced by that point that he was going to win. I didn't think there was any point hanging around for a price above evens, as he was looking far better than Nadal. I only went in with half stakes, as Nadal was still level at the time and Djokovic's price was moving out. But my cautious mindset panicked at the first sign of Nadal picking his game up and I bailed out early for a small red. Nadal didn't trade above evens the entire match. I was gutted because if I'd just held on for a few more points (and I was on half stakes so should have allowed for a bit longer holding my position) I would've ended with my largest win for months.

The problem with being as 'sure' as you might like to be before having a bet in play, is that by the time you decide, the bet is likely to be gone. Trade enough, and you learn to harness the 'Blink'* instinct that I have written about before on here. And my advice on panicking at the first sign of trouble, is the same as that of Corporal Jones in Dad's Army - don't. Easier said than done, you might say, but it often pays to "be greedy when others are fearful, be fearful when others are greedy" - Warren Buffett. What is essential here though, is that you stake sensibly. Nervous money doesn't win. Over-staking leads to poor decisions, which lead to losses.

A poster on the Betfair forum had this interesting statistic about BETDAQ's change in fortune since the Super Premium Charge kicked in:

Quite an upturn for them, and some reports suggest that horse racing markets are also steadily improving. Betfair may well live to regret their latest move. While it may be true that only a small number of customers (750?) are directly affected, thousands more are indirectly affected. Either they are closing in on the finishing line, or if not any time soon, at least they aspire to at some time in the future, or they are impacted by thinner markets and less value as the big boys depart for greener, or purpler, pastures. Not to mention that it's very poor PR and people like myself who would have happily married Betfair a few years ago no longer feel the same way. If BETDAQ picks up in the markets less travelled, like many others, I'll be gone.

Boring stuff now, (ok, even MORE boring stuff), and two inter-league games tonight; Manchester City v Napoli and Villareal v Bayern Munich. My crazy spreadsheet thinks City should be at 1.7 v Napoli, and that 1.36 is a value lay. I'm not so sure, and whover said "numbers don't lie" obviously never tried making money from football betting. The Under 3.5 at 1.54 looks value.

Bayern Munich at 2.18 are value to win at Villareal, but no value on the Over / Under as my numbers fall almost exactly where the market currently sits - 2.11 U, 1.9 O.

The Europa League on Thursday has just one inter-league game, which is Udinese v Rennes. I have Udinese at 1.79, the market at 1.94. Unders for me is 1.85, the market around 1.91.

I checked my Premium Charge statement yesterday, and I know I have posted when I have been at 19.99% and had to pay, but last week luck was on my side:

* For any newcomers to this blog, Blink is a book by Malcolm Gladwell, about the first two seconds of looking--the decisive glance that knows in an instant. Add it to your Xmas list as I urged you back in 2008. It's very relevant to trading and the markets. Sometimes, you just KNOW when a price is wrong.

An article in the Racing Post on the topic of Betfair's bonuses to management despite the company's poor performance since flotation has apparently been pulled. Anyone who might suggest that Betfair had some influence on this decision should be ashamed. Betfair's advertising money would have no influence on editorial decisions.

Fortunately for us, the Guardian is there in our time of need:

Betfair faces the risk of a showdown with its new shareholders after a leading UK investors' organisation raised concerns about potential bonuses on offer to executives at the troubled gambling group. The Association of British Insurers has published a so-called "amber-top" alert to shareholders of the FTSE 250 company, which is reeling from a 46% fall in its share price since its listing in October.

The report by the ABI – whose members account for almost 15% of investments in the London stock market – has highlighted the group's long term incentive plan (LTIP), because the targets that Betfair executives will need to hit to gain future awards are not defined in the company's annual report.

It has also raised the issue of one-off bonus payments made to executives last year, while acknowledging that the windfalls were disclosed in Betfair's flotation prospectus.

Despite the poor share performance since flotation, it emerged in July that the total pay of chief executive David Yu had risen by 125% last year to £824,676, while finance director Stephen Morana had taken a 445% hike to earn £1.6m.

A spokesman for Betfair said: "The company is still in discussions with the ABI. This is still a draft recommendation." Betfair also pointed out that the amber-top warning concerns the LTIP and not the one-off payments.

In July, Betfair's first annual report revealed that the total amounts paid to Yu and Morana last year were inflated by the so-called "senior executives' incentive plan" (SEIP), under which Yu received an extra £300,000 and Morana £1.2m. The report stated: "The 2010 SEIP granted certain senior employees and executive directors one-off conditional awards consisting of a cash amount and an award of nil-cost options on admission to the stock exchange."

Betfair's annual meeting is scheduled for 22 September, although it is unlikely that it will see a massive vote by investors against the company's remuneration policy: despite October's float, founders Ed Wray and Andrew Black still own around 21% of the shares, while long-term shareholders Softbank and Charlton Acquisition hold around 11% and 10% respectively.

On Tuesday, the company said its second quarter had started strongly, following an expected drop in its first-quarter revenue when it faced a tough comparative period that included last year's football World Cup. The group added it was comfortable with estimates for the full year of revenues of about £346m from the company's core business and £390m in total sales.