April hasn't been the most productive month in terms of posts, with the distraction of a rare FA Cup Semi-Final appearance by my club, as well as travel opening up again for work which is great for air miles and car rental and hotel points, but disruptive to my usual routine. My next trip is in early May, one week from today, but despite the lack of new content, the number of hits is higher this month than last.

Derek McGovern actually wrote about this in the early days of internet, you could get the results of matches and the bookies were still pricing them up a few hours later.

With new technology comes new opportunities, at least for a while. The film 'The Sting' from the early 1970s featured a similar strategy for horse racing using delayed wire transmissions, but I suspect opportunities these days are rather few and far between as technologies become ever more sophisticated.

On the topic of the relationship between calories, exercise and weight, Simon M commented:

The book "Burn" by Herman Pontzer (the Associate Professor of Evolutionary Anthropology at Duke) published last year is very good on why exercise probably doesn't burn calories (like a car burning through petrol) yet is still healthy.

I thought the book was overlong (although I would still recommend if you are interested in the topic) but his appearances on free podcasts and magazine profiles do a good job of going through his research on exactly how many calories us (and our fellow mammals) burn.

Example: https://www.menshealth.com/uk/weight-loss/a39350294/dr-herman-pontzer-training-for-weight-loss/

I actually bought this book when it first came out, and can also recommend it. While 319 pages is quite a lot, if you're interested in this topic, and let's face it we all should be, it's well worth the time. Not surprising to read that amid mostly favourable reviews:

There have been two areas of pushback: one is people whose careers depend in one way or another on exercise being a great tool for weight loss; the other is the keto and carnivore bros, who don’t want to hear that we didn’t evolve to eat 100% meat.

Months with work travel are never good, and with the excesses around big football matches and the Tyson Fury fight, it's not looking like a losing month on the scales, with losses unfortunately currently being achieved on the investing front. We still have five trading days to go, but at the time of writing I am down 1.23%.

A couple of Draws for Leicester City in the past few days mean that the ROI on the EPL Draw System now stands at 11.2% for the Close selections and 29.7% for the Toss-Ups. With just five rounds left, the two Merseyside clubs are keeping things interesting. Everton have played the most seasons in the top flight, and are the only 'Original 12' club still in the league never to have played outside of the top two divisions. They've been relegated just twice in their history but are now favourites to join Norwich City and Watford in relegation.

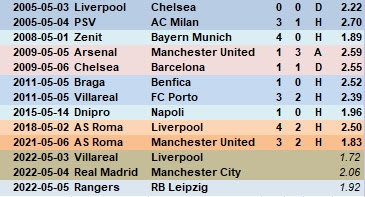

In March I mentioned that "In European competition, in Second Leg matches where the Home team has more than a one goal lead from the First Leg the value historically is on the Away team" and that "there is also an edge on the Away team when the First Leg was a Draw".

Hopefully some of you cashed in with 6 of the 7 Away teams winning this month, and a 16.13 unit profit. The one losing bet was a Draw at 5.07 odds. Of the other five ties, coincidentally all with the Home side trailing by one goal, only one result was an Away win.

One of the blogs on my blog roll is Bob Dancer's Gambling With An Edge. The world of Video Poker isn't an are of interest for me, but I enjoy reading some of Bob's thoughts and in a recent post he talks about how our reactions to profits and losses varies.

Read the full post here, but essentially he "won" a $10 voucher from a grocery store on the same day as he lost $750 playing (I assume) video poker, and upon returning home, told his wife that he "felt great about that $10 win while the $750 loss immediately afterwards didn’t bother me at all."

His wife's bemused reply was “Your thinking is so messed up!”

I can certainly identify with Bob's thought process here. Some 'losses' are good, or at least healthy and simply part of the natural order of things. A four figure decline in the value of a stock index fund - not a rare occurrence if you have £100,000 or more invested - doesn't feel anywhere near as bad as a far smaller loss that was unexpected (dropping your iPhone and needing a new screen for example!)