that the exchange will be closed either Friday or the following Monday if the holiday falls on a weekend, unless “unusual business conditions exist, such as the ending of a monthly or yearly accounting period.”

Friday, 31 December 2021

Spreadsheet Love

Wednesday, 8 December 2021

Goodbye 2021

Wednesday, 17 November 2021

Reading Between The Lines

Hello again, thx for the citation of my comment. Another part which is very interesting to me: The direct influence of officiating in the NBA this season. As mentioned here: https://www.msn.com/en-us/sports/nba/nba-rule-changes-2021-explained-referees-will-no-longer-reward-abnormal-moves-from-foul-hunting-stars/ar-AAPaKRaHow does this translate to the betting market and odds/lines/totals? If the lines of gimmethedog are correct. Blindly betting unders are 120-76. 2020 over was 581-575 for Overs. 2019 575-543 for Overs. So the Market AND the bookies hasn't transformed yet to these changes. The totals are very inefficient. A 60% edge is very unusual.

Sunday, 14 November 2021

New Balls? Please!

Mr. Portland (Oregon, not Maine), informed me that his rationale had been that he'd been "wiped out" on the Sunday games, had decided that the Monday game would definitely go Under, but because he'd lost so many bets on Sunday he went against his "research" and backed Over. But he did want to make clear that he wasn't a complete idiot by telling me that he only bets $25 a time. This assertion (about being an idiot) was later found to be false, with the conversation turning to politics and references to "Sleepy Joe Biden", and the wild claim that "it's impossible to make any money from sports betting". I bit my tongue (again) on both topics. There was a lot of tongue biting that night.

Ultimately the game was comfortably Over finishing with 56 points, and with that bet a winner, he turned to his phone and started looking at betting on the outcome of the next play, soliciting opinions from the small group present. By this time we had been joined by a couple of slightly more normal people, one a German living in Brazil, the other an Angeleno, who both found the whole situation highly amusing, especially when towards the end our friend was about to back the Bears to win the game until I pointed out that the Steelers only needed a field goal to win the game. Cue total astonishment from the Portland Proud Boy, exclaiming "Oh yeah, that's right!" and a change of strategy subsequently rewarded with another winning bet when the required field goal was kicked with 26 seconds left. I was half expecting a beer for my troubles, but no that didn't happen.

I asked Mr. Portland which sportsbook he used, and his answer was Bovada, a company with a good reputation in the US but who typically post -110 lines (1.909) on 50/50 bets, a vig that would make it difficult to make money long term.

Prior to leaving, it appeared that "backing Unders when the total is greater than 212.5 is currently the best bet".

As mentioned in the last post, the "overt, abrupt and abnormal" rule change has had a significant impact on scoring, but there is one other factor that may be partly contributing which is the revelation that after 37 years of using a Spalding manufactured ball, the NBA now uses a Wilson.

Larry emailed me with this link, and worth a read if you're interested about this kind of thing. One paragraph states:

While it’s still early in the season, the league is currently experiencing a temporary shooting slump, with an approximately 2% lower overall field goal and three-point percentage compared to last year. While a short offseason and new foul call interpretations have been subject to blame, some trainers, players, and analysts are now pointing towards the new Wilson ball as a possible issue.

While I think the primary reason for the decline in points is the new rule, it is certainly possible that the change of ball is a secondary contributory factor. Some players are talking about it, although of course being able to blame the ball rather than your poor shooting could be convenient.

Paul George of the Los Angeles Clippers is quoted as saying:

"Not to make an excuse about the ball, but it’s a different basketball. It doesn’t have the same touch/softness that the Spalding ball had, and you’ll see this year. It’s gonna be a lot of bad misses”

He himself seems to have adjusted just fine, currently fourth in the points-per-game category, up from 22nd last season.

As to my comment regarding the 212.5 line, the record now for the season at this entry point is 98-57-1 which is 63%, and in November is so far 40-30 (57.1%). I am indebted to schnakenpopanz for pointing me to gimmethedog.com in his comment:

Hello, long time reader, but only my first comment. Thx for all the work you put in, I learnt a lot from your experiences.

I have been working together with the killersports platform a while ago and been active in several subgroups and worked with a lot of people from the core group.

So I think this will be quite interesting for you. killersports as you know it may not exist, but there is a subsite formed by other members which continues the SDQL format.

So far it is in beta testing and hopefully will catch up to the painful emptiness that killersports aka sportsdatabase left us with.

http://gimmethedog.com/

I have used it for test purposes a lot right now and it looks solid, but shortcuts we are familiar with may not work from the get go. It looks promising.

If there are other things I may help with, feel free to ask.

Cheers.

Cheers indeed as beta testing or not, this is looking to be a hugely useful site. Many thanks to schnakenpopanz for sharing this.

Some of you may recall that AT asked about Small College Dogs recently, and while the Gimme The Dog site doesn't recognise the "Division" parameter, the numbers for all matches this season shows a less than exciting record of 44-45.

Dr Tsouts commented that:

I am tracking most of Cassini's systems for almost 2 months and I am slightly negative on NCAAF handicaps with a record of 26 wins, 28 losses and 2 void. But numbers are better when following straight wins with 9 wins and 13 losses and a 8.3% ROI. The picture in NFL is great and I am waiting a correction but now I have 7 wins and 4 losses in straight wins (money line) and 27-11 in handicap with the extraordinary 27-11 record!

The record is now 28-13 record with four selections this week.

Thursday, 4 November 2021

Overt, Abrupt and Abnormal

Numbers definitely down and here's some stats after 2 weeks into new season which may interest you.

Fewest number free throws per game in modern era of NBA

Lowest offensive efficiency number since 2014

Lowest 3 point % since 2003

Lowest field goal % since 2000

One area to keep an eye on, and which may slow - or even reverse - the steady increase in points scored, is the NBA's rule change concerning fouls on shots.

The rule change I was referring to was the one implemented ahead of this season to:

discourage offensive players from making "overt, abrupt or abnormal non-basketball moves"Essentially, NBA referees will no longer reward offensive players who launch themselves into defenders.

Wednesday, 3 November 2021

Totally Out of Reach

Good effort, with the weight loss. I need to do the same!

Losing weight really isn't difficult, although it's not as easy as gaining it, but it's just so boring! I do find it motivating and critical to keep records but basically it simply requires self-discipline, and for one's social life to grind to a complete halt. Fortunately, when I set my mind to something, self-control isn't an issue, and so far as social life is concerned, it helps that I'm not very popular.

Diego commented about my NBA Killer Sports comment that it was "Early days, and the unavailability of Killer Sports for the NBA this season is certainly an inconvenience" writing:I don't know what you miss about KillerSports, but athttps://s3.sportsdatabase.com/NBA/query.htmlyou can do basically the same queries. For example:

date, team, o:team, total@total>=230 and site=home and date>=today

By the way, thank you for the blog, I enjoy it a lot :)

This does work for selecting the matches, although I'm struggling to see how to get the game results to display. The SDQL is certainly different from the very easy to use Killer Sports version, but if there's a manual somewhere this could be a useful resource. Anyway, thanks for the lead Diego and the 'official' results so far from the NBA Overs System are now 0-0! The 234.5 mark may be a tad high.

AT commented:

Do you not play Small College Dogs anymore? I've read most of your blog and never saw where those dropped out of the regular rotation

I stopped publishing the College Football Small Dogs when Killer Sports stopped tracking them. I like the results of my systems to be verifiable, and identifying qualifying matches (I focused on Division 1A colleges) went from a few seconds to, well, much longer. With, I believe, 254 colleges in Division One football, it's no small task doing this manually and I like an easy life.

Referring to the NBA totals, Annis asked:

So what was last year’s average total

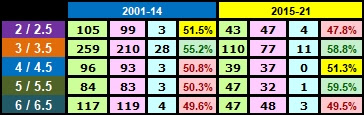

The table below shows the total used for backing Overs since we noted that the points being scored were steadily increasing:

If the question is asking what was the average total points per game last season, the answer is 224.2, i.e. ten fewer points than the 234.2 we are looking for this season.And I think that is it for comments, but there was an interesting Tweet that @statsbet looped me into.

I do like things like this, so thank you Statsbet. The Tweet was this:Aside from the missing apostrophe, the last sentence is absolutely correct. I'm pretty sure no sane person would ever have their entire retirement savings fully invested in stocks, because as this example shows, that's a recipe for disaster. A couple of bad years early on, and you're out looking for a janitorial position to boost your income!A lot of this was actually covered recently in my Diving Into Retirement post where the conclusion was that even a 4% withdrawal from an S&P 500 Index Fund would have resulted in running out of money on 13 occasions since the Index's inception, so 5% would be bordering on reckless.

The story of DFA (Dimensional Fund Advisors) is covered in the "Trillions" book mentioned in my last post. Chapter 9, "New Dimensions" if you're interested.

Monday, 1 November 2021

Perfect Storm, Indexes and Eating Pies

Fortunately it's [September] the only such month, although a little concerning that October is the next worst month.

Of the stocks I've mentioned here previously, Tesla, Boeing and Lloyds Bank were all up on the month, while Bitcoin, Pfeizer and Berkshire Hathaway were down.

In the January 2000 issue of The Atlantic Monthly, Glassman and Hassett replied to a critic of their theory that "if the Dow is closer to 10,000 than to 36,000 ten years from now, we will each give $1,000 to the charity of your choice." For the Dow to be closer to 10,000 than to 36,000, it would have to be below 23,000. As things turned out, the index was not even at half that figure ten years after Glassman and Hassett's prediction (the Dow's highest close in January 2010 was 10,725, reached on 19 January). In early 2010, Glassman and Hassett conceded they lost the bet and they each donated $1,000 to the Salvation Army. It wasn't until 18 October 2017, coincidentally the day before the 30th anniversary of Black Monday, that the Dow closed above 23,000, thus finally reaching more than halfway from 10,000 to 36,000. Following multiple downturns, including the 2020 stock market crash, the Dow continued rising toward the titular milestone, finally reaching 36,000 on 1 November 2021 (but has not closed above it).

Target is 20lbs and, unlike some of my financial targets, this one is all up to me.

After a month with an average daily intake of just 1,095 calories, 196 miles covered on foot - mostly walking, but with a little running, 166 miles ridden on the bike, no alcohol and no meat - I did eat a lot of fish though - the final tally for pounds lost was 20.8, which is my best ever 31 day total beating the 19.8 pounds lost in January 2016, another "dry" month. Losing weight gets tougher the older you get and although I suggested "this one is all up to me", there's only so much one can do, and it was very pleasing to hit that 20 pounds number this morning.

With a work trip to the Windy City this month and the Xmas festivities in December I shall no doubt be doing "Dry January" again in a couple of months in an effort to lose the probable 'gains' between now and then. This health stuff never ends! As the Daily Mash reported in 2015:

If you want to be fit you have to keep doing exercise forever, it has emerged.

Healthy eating and sport have been condemned as a scam after it was revealed that they only lead to more healthy eating and more sport.

Carolyn Ryan of Cardiff said: “After two months of going to the gym I asked my personal trainer when I’d be fit enough to stop all this and eat the fuck out of some pies.

“The look on her face. She said that if I relaxed my diet regime even for a week then the fat would pile on again even faster than before, and if anything I should be stepping it up.

“I thought it’d be like A-levels where once you’ve passed you never think about history ever again, but it’s more like revising history five nights a week for the rest of your life.

“She says after a while I won’t even want a Toblerone any more. That made me cry.”

Personal trainer Donna Sheridan said: “Getting healthy isn’t a sprint, it’s an endless marathon through featureless terrain pretending that chips and sitting around watching telly don’t exist.

“However I do have the warm glow of knowing that I’m better than everyone else.

“Unless they’re right and I’m the moron. Which I occasionally think, but I get that out of my system with a nice eight-mile run.”

Wednesday, 27 October 2021

Stock Crashes and Squirrels

Zang played Magic: The Gathering during high school and won a Chinese championship in the card game. He graduated from university in 2005. In 2013, he founded a company specializing in Bitcoin in Shenzhen. In 2019 he got a pet squirrel.

Sunday, 17 October 2021

NBA 2021-22

Thursday, 7 October 2021

Wild Card Winners

Tuesday, 5 October 2021

Comments!

Do you suggest MLB favs strategy only for regular season?

If the question is what I think it is, i.e. do I recommend the 'Hot Favourites' strategy in playoffs, then the answer is yes, if the team are playing at home.

When the team is from the National League the Money Line (ML) ROI is 22.1% from the 24 matches, with a similar number for the Run Line (RL). In the American League, the respective numbers are 11.7% and 20.9%, and interesting to note that there has only been one loss from 13 bets since 2007.

For all favourites, there's a rather unusual difference between backing them on the Money Line or the Run Line, with the former showing a negative ROI of -4.1% and the latter a more positive 3.0%. This is seen in both the National League and American League.

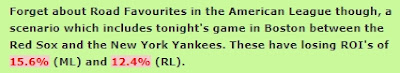

Forget about Road Favourites in the American League though, a scenario which includes tonight's game in Boston between the Red Sox and the New York Yankees. These have losing ROI's of 15.6% (ML) and 12.4% (RL).

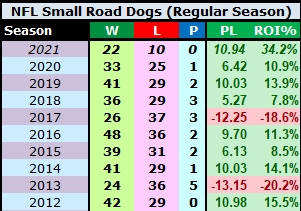

The second comment, also from the aforementioned Dr Tsouts, was regarding the winning start to the NFL season for the Small Road Dogs:

Regarding NFL strategy a vast majority of the selections have won straightforward!

Indeed they have, although last night's bet on the Las Vegas Raiders was a loss on both the Handicap and Straight Up. Killer Sports is under new management, and their numbers for this season are not correct - for example last night's loss is showing up as a win, but hopefully this will be corrected soon.

The third comment was on my "Retirement" post and BabyDuck (why not duckling?) suggested that I:

Get spending! White Hart, Chipstead to discuss trip/s to West Indies for England's tours next Jan-Feb and/or March. All on you!

With my annual bonus coming in March, I will not be negotiating any kind of severance before then unfortunately, but combining travel and watching sports is certainly high up on the agenda for those early years of retirement.

For the record, the White Hart is a decent pub in a very nice village. My mother was raised in Chipstead and my son played for the Youth team there.

Monday, 4 October 2021

T-Bone Cooked, Wild Week Ahead

Sunday, 3 October 2021

Game 162

Four teams -- the Yankees, Red Sox, Mariners and Blue Jays -- remain in the hunt for the two AL Wild Card spots, though the Yanks and Sox have at least guaranteed themselves an opportunity to play in a potential tiebreaker game. Both would clinch a spot in the AL Wild Card Game with a win. If the Yankees (hosting the Rays) and Red Sox (on the road against the Nationals) both win on Sunday, then Boston would host New York in the AL Wild Card Game on Tuesday (Red Sox won the season series, 10-9, giving them home-field advantage for the winner-take-all showdown).

Of course, if either of them lose, it would open the door for the Blue Jays and Mariners. Toronto needs a win at home against Baltimore and a loss by New York or Boston to set up a potential tiebreaker game on Monday for a chance to earn a Wild Card spot. Likewise, the Mariners -- who kept their postseason hopes alive with a dramatic comeback on Saturday night -- need to beat the Angels again on Sunday afternoon, and get a loss by either the Yankees or Red Sox, to put themselves in position for a potential tiebreaker game.

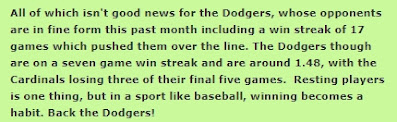

All games start at the same time today, 8pm BST. The Boston Red Sox and Toronto Blue Jays are both probable selections for the Hot Favourites System which looks to have a busy day with three other matches likely. The Yankees aren't a qualifier as they face the Tampa Bay Rays who won their 100th game of the season last night, the only AL team to do so this season. In the NL, two teams from the West Division have both achieved that - the Giants and the Dodgers.

We also probably have five selections for the NFL's Small Road Dog System today.

Good luck if following.

Friday, 1 October 2021

Sobering September

Friday, 24 September 2021

Diving Into Retirement

Most gamblers are probably best served by using a flat 2% of their bank per bet, since figuring edges in sports is, as mentioned earlier, very difficult.

It's a number that I have stuck pretty close to over the years and which has served me well. While I also suggested that "Increasing this to 3%, or occasionally 4% on an especially good play, is reasonable", a naturally conservative person such as myself gets a little uncomfortable with 1/25th of the bank at risk on any one bet!

And now thirteen years on, a similar, but more important calculation is when to retire and how lavishly do I spend in those early years of retirement before old age replaces living with "existing" and ultimately "existing" with "death."

Hopefully the "existing" period, if it occurs at all, will be brief, because it doesn't seem to offer too much in the "things to look forward to" category. [At 94, my Dad has this week moved out of the house he has lived in since 1955, close to 66 years, into a care home so excuse the depressing tone of this post so far.]

Anyway, back to those early years of retirement and the risk is that if you spend too much, you can be left with a shortfall in later years, but if you spend too little, you're not going to enjoy that retirement too much.One frequently used rule of thumb for retirement spending is known as the 4% rule, or eponymously the Bengen Rule" after William P. Bengen, the retired financial adviser who first articulated the idea.

It’s relatively simple: You add up all of your investments, and withdraw 4% of that total during your first year of retirement. In subsequent years, you adjust the amount you withdraw to account for inflation. By following this formula, you should have a very high probability of not outliving your money during a 30-year retirement according to the rule.Another way of putting it is that your portfolio should be at least 25 times your annual expenses (plus taxes) in retirement.

Anyway, 10-K Diver is one of the accounts I follow on Twitter and they had a very interesting thread on the 4% Rule, the basics for which are:

Suppose your retirement portfolio is a well-diversified basket of stocks, like the S&P 500.

Historically, such a basket of stocks has returned ~7% per year, plus ~2% in dividends. This is a total return of ~9%.Assuming your annual expenses grow at ~2% per year (roughly the rate of inflation), your portfolio -- which is growing much faster at ~9% per year -- should have no trouble financing your expenses in perpetuity.This means you'll never run out of money.

Here's the chart over 30 years with those numbers:

Which is all well and good, but as most readers will be aware, that 7% increase each year in the stock portfolio is about as consistent as our betting returns. Of course over the long-term they are profitable but profits are not consistent from season to season, and edges can disappear over time or overnight.The chart to the left shows the annual percentage increases and declines over the last 29 years with the average and median actually above the 7% mark which goes back to 1871, before the Football League was formed and just 10 years after Crystal Palace FC was formed. If you know, you know.

Anyway, I encourage you to read the thread in full for yourself, but 10-K Diver back-tested the 4% Rule going all the way back to 1871 and did a "what if Joe had retired in year...". The result was that Joe would have run out of money 13 times, most recently if he had retired in 1972 and lived to 2008, which is 36 years of retirement and not a duration I'm likely to experience.

The shortest period before going bust was 23 years, when a 1968 retiree would have gone bust in 1991.

Back to Bengen, and "based on his early research of actual stock returns and retirement scenarios over the past 75 years, Bengen found that retirees who draw down no more than 4.2 percent of their portfolio in the initial year, and adjust that amount every subsequent year for inflation, stand a great chance that their money will outlive them."Given that the 4% rule fails sometimes, what's the solution?

10-K Diver then applied a 3% rule, i.e. the portfolio was 33.3 times that of the annual withdrawal. This time there were no failures, not one instance where this rate of spending would have ended in disaster.

So 10-K Diver took the idea a step further, and did some stress testing, a term some of you working in IT will be familiar with, and no, it doesn't refer to the weekly one-on-one with your manager.What this entailed was looking at the worst periods in history, so the worst one year period was 1930-31, the worst two years from 1929-31 and so on.

For our stress test, we'll assume that in our first year of retirement, stocks will deliver the worst 1-year return in history.After that, he assumes the average 7% growth and allows for inflation to be at 4% rather than the original 2%. His findings:

And in our first 2 years of retirement, they'll deliver the worst 2-year return in history.

And so on, for the first 20 years.

How well do our rules serve us in this stress test?

Well, the 4% rule runs out of money in 10 years.

The 3% rule runs out in 13 years.

The 2% rule runs out in 20 years.

The 1% rule never runs out.Once again in life, the 2% rule looks likely to suit me perfectly. As 10-K Diver said in a reply "The 4% Rule will likely work most of the time. But it’s a bit too aggressive for me personally."

But when it comes to retirement, it's far better to overshoot than undershoot.The thread and replies also contain some interesting ideas, for example one was about maintaining a separate cash float to use instead of withdrawing from the portfolio after a bad year, which I like.

You do not want to run out of money in old age.

And even if it turns out you've been too conservative, that's not so bad. You get to do more charity, leave more money to your kids, etc.