I'm a little bit late with this update, but February was an interesting month. It had the extra Leap Day this year, which to salaried employees like myself is a slight irritation as it's a day we don't get paid for, but that wasn't what made it interesting.

As I mentioned before, I started the ball rolling on one of life's big decisions, i.e. retirement, and March could be an even more interesting month, although I'm not sure how quickly such a ball gathers momentum, nor which slot on the wheel of life it will ultimately land in.

Given a few recent issues with the company - there are significant "cost pressures" and "financial headwinds" and the share price, which had its first annual loss in 15 years in 2023 is already down almost 10% year-to-date - as well as contractors being let go later this month, it doesn't seem too far-fetched to believe the rumours that some full-time employees are also likely to be made redundant in the not too distant future. Best case scenario is that I can negotiate an enhanced individual severance deal sooner rather than be one of many lumped together in a layoff deal later in which the terms are unlikely to be open to negotiation.

I first entered the workforce on 11th August 1975, which I don't need to add was a very long time ago. One of the places my work has taken me over the years was the state of Arkansas where I spent a few years in the 1990s, and I shall be returning there later this month for a five week visit.

The primary reason is to be in the path of totality for the total solar eclipse on the 8th April, but I shall also be meeting up with my son who has a work trip in Wisconsin which overlaps, and he's keen to visit the area where he spent a few of his early years before moving back to the UK.

In addition, I still have a few good friends in the area and it will be fun to catch up with them again, and I also plan to rent a bike while I'm there as cycling trails are now plentiful there. This blog will therefore have its longest sequence of silence since its debut in 2008, also a long time ago, at least as far as sports investment / betting blogs go. Whether the trip ends up being a workation or a vacation remains to be seen but having heard today that there has been a significant number of resignations follow the annual reviews, though none (yet) from my team, I rather suspect that I shall not be receiving an offer.

As for February, well in sports investing it was rather a quiet month. The NBA season had its usual interruption at this time of year for its All-Star Break but when there were games, it was a good month overall with a 41-28-1 record ATS for the basic system, which is a 59.4% strike rate and for the season to date the percentage is 52.2%. The Overs had a small loss, but at 53% overall for the season, we're still in good shape here too, with the number to beat 51.2%.

Disappointingly, after a strong January, the NHL system dipped into the red after their All-Star Break and is now down 3.43 units, an ROI of -0.9%. February is usually a strong month but this year was the worst since 2007. It happens.

The "All-Big 6" League Cup Final was a winner of course and for those of you backing the Draw in "All-Big 6" League matches also this season, at the two-thirds point of the season there are worse things you could be doing since this is now +28.87 units (144%) and the strategy is guaranteed to finish the season in profit. Note that the Pinnacle overround is creeping back up again as it did in the COVID affected 2019-20 season, a number that is higher in matches involving a Big 6 club than in those "Little 14" games.

The small number of matches each season means there will be some big winning and losing ROI percentages, but overall a 12% ROI over the last ten seasons (with ten matches to go) is very good.

Meanwhile over in Italy the Serie A System is performing well and while the ROI is "only" 8.4% from 720 games, it's worth paying attention to.We're getting close to some more big games. The European Knockout rounds are here, and the end of season Finals and playoff games aren't too far off either with the Euros the icing on the cake.

Overall February was a good month for the main spreadsheet, with a new end-of-month high ending the 23 month wait. March hasn't started particularly well, but it's early days and a drawdown of 0.4% is nothing compared to the 23.4% from March two years ago. Bitcoin set a new all-time high this week, and is currently up 72% this year. Tesla isn't.

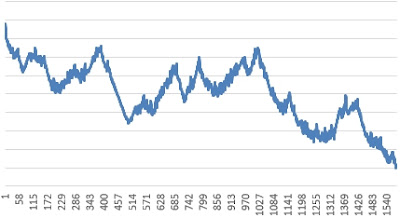

As for health and fitness, without which there is no point being concerned about money, it's mostly good news. I joined a gym at the start of February (good news) and have been there just three times since (not so good news). I much prefer being outdoors and have been out on my bike a few times and my walking / running still exceeds six miles a day on average. Dry January was followed by an almost Dry February with just one drinking day, and the pounds have been falling off - hopefully fat rather than muscle - and I am now down by more than five and a half stone (78.4 lbs to be precise) from my high in 2019. Similar to the financial mindset change needed to adjust for a move from earning and accumulation to retirement and decumulation, so I need to figure out how to adjust to the idea of maintaining a healthy weight rather trying to attain it. Nice problems to have though. In another commonality with building wealth, losing weight (by which I mean fat) isn't hard, but it's slow and it's boring. The simple chart above shows where I got bored! The longer downward slopes are where I was more focused, and the instance starting around 380 days was when I was laid up in bed with a broken leg - zero alcohol and my wife had total control over my caloric intake - and I couldn't weigh myself daily for 11 weeks.