2023 is not only the second consecutive year that is a harshad number and it is also an Eyeball Year since its binary representation only contains two zeroes and they are consecutive.

Fascinating, I'm sure you'll agree. Maybe.

As I wrote in my opening post of 2022, Harshad is a Sanskrit word which means 'joy-giver' and while I commented at the time that "hopefully the year will live up to its categorisation and do just that", for many of us it didn't.

Looking back a year, and it seems that not much has changed in the past two years. I wrote a year ago:

As for the year just gone, much of what I wrote in my review of 2020 a year ago remains true.My job isn't really work these days. It's all meetings and management and if I can do it full-time from home, and by full-time I often mean for two to three hours a day, then I might as well hang in there until the next bonus and stock options are doled out at least, which is next month. Were my job hacking away at a coal face, my attitude to retirement might be a little different.

I'm getting boring. A year on, and I am still working, with retirement presumably closer, but motivation to pull the trigger is still very much tempered by the fact that I do very little actual work. My office was closed in 2022, so aside from the occasional work trip, and due to cost cutting, those haven't been so plentiful, all the work I do is from home. The possibility of a 2023 trip to India has been mentioned, and that would be an incentive to stay, but I am starting to consider the end of June as a good retirement date.

My daughter is expecting her third child, and my fourth grandchild, on the 30th June, which is an extra nudge towards that date, but knowing myself as I do, it will all depend on how the stock markets perform in the next few months and how much of a golden parachute I can negotiate.

Two of my peers were let go in November, and while I don't know exactly what redundancy terms they received, it was probably somewhere between 6 months and a years salary, either of which would suit me just fine. I complete 20 years of service with my firm in a few days, so I would expect to be close to qualifying for a year's money based on the formulas I have seen when having to lay people off myself, but if the decision to walk away is mine, I'm not sure how generous they might be.

While work isn't exactly onerous as I've mentioned, I do need to keep an eye on the clock, as the good years of retirement can quickly evaporate. While I still feel physically good today, it might not be that long before the leg I broke in 2021 develops arthritis, or something else happens in an instant that reduces or removes the ability to travel.

Psychologically I know that I need to be close to, or at, an all-time high but 2022 wasn't helpful. This was my first down year since I started tracking these things in 2009, with my net worth total declining by 11.6%. At my age, this number is all about investment performance, with income from employment pretty much irrelevant.

I did warn myself a year ago that:

Of course the stock market will crash at some point, but predictions have been out there for at least eleven years now, and if you'd moved to cash at that time, I'm pretty sure you wouldn't be too happy.

We've all been rather spoiled over the past two decades with low inflation, and a bull market that aside from the crash of 2008 saw the FTSE100 index decline by more than 6.5% just twice, and the USA's S&P500 index never, until 2022 when it dropped by 19.4%. Last year was just the second time (2016) since the crash of 2008 when the FTSE100 index has out performed the S&P 500 index, which readers will know has been my preferred index for many years.

One interesting observation from A Wealth of Common Sense is this:

The stock market probably won’t give us “average” returns. Depending on the time frame you use the long run annualized return for U.S. stocks is something in the 8-10% range.

The strange thing about investing in stocks is any given year rarely gives you anything close to that range of returns.

In fact, going back to 1928 there has been one single year of returns that fell between 8% and 10% (1993 when the S&P 500 was up 9.97% in total on the year).

Most of the time the stock market is up big or down big on the year. From 1928-2022, 70% of all years have seen double-digit gains or losses.

A great example of how averages, at least in the short-term, are often not very useful.

As for my individual stocks, Tesla had a terrible year, with it's CEO Elon Musk going from an absolute hero to a complete zero in the space of a few months. After closing at 352.26 last year, the stock is now priced at 123.18, a decline of 65%.

Tesla is still my best performing share, up 488% since I purchased them in November 2017, but the distraction of buying and running Twitter, along with Musk's need to finance the purchase by selling Tesla stock, has clearly had an impact.

Musk has always been a bit of an odd character, but he seems to be having some kind of mid-life crisis and his political views, unpleasant to the majority of people, and certainly to his customer base, have likely reduced the demand for Tesla cars.

Unfortunately the Tesla board is comprised of "Elon Musk, his brother, and people they control. It’s a public company in name only, and is controlled by a clique of insiders. It will be shocking if they move against him."

After cashing in some of the shares a year ago, I am now playing with house money and can watch from the sidelines, but what was looking like a great investment at one time has now become an interesting one to watch for all the wrong reasons.

I've mentioned in the past that I invested a small amount in a Bitcoin trust, and that has preformed terribly with cryptocurrencies in general struggling after the recent FTX scandal. I know exactly why I dipped my feet into Bitcoin, simply a FOMO play, but since they are not income producing assets, “investing” in crypto is purely price speculation, or gambling, and I'll not be adding to my position.

One of my best individual holdings continues to be Warren Buffett's Berkshire Hathaway which I bought a little over two years ago and has quietly increased by a little over 37% in that time. It's not a jazzy holding, but it's a very solid one, and as regular readers will know, I'm a long time fan of Warren Buffett and his philosophy, although changes at the top for Berkshire Hathaway are unavoidable fairly soon with straight-talking vice-chairman Charlie Munger turning 99 yesterday.

Of course with my stock, stock options and RSU holdings, my company's performance and share price is hugely important, and while a repeat of 2021 was always unlikely, a year when the stock was up 45%, it did at least manage a market beating 5.6% increase in 2022.

For sports investing, 2022 was a steady year with a total gain of 5.28%. The glory years of 2006-2014 are a distant memory, but it's still possible to make steady profits with a disciplined approach. The markets for US sports appear to be evolving rapidly as the betting landscape over there changes, but the loosening of betting restrictions in many states was always likely to be disruptive.

The 2022 College Football season is almost over, with a few Bowl Games and the Championship game next Monday where Georgia (-13.5) are favourites to beat TCU. The Away Small 'Dogs System 'officially' recorded a 41-34 winning record, an ROI of 6.7%, but as detailed back in October, Killer Sports doesn't include all college matches and individual results will therefore vary. (Individual results will always vary, depending on the time selections are identified, and the method by which they are sourced.)

The NFL season is still ongoing, with the regular season ending up next Sunday, but at the end of 2022 the ROI was 9.5% with a winning record of 31-24-3 with the related Divisional System recording a 17-15 record for a 3.7% ROI.

So American Football was again profitable, but it's not the same story in the NBA where both of my systems are struggling quite badly. The Road Team System is currently down almost 20%, and a first losing season since 2005 looks certain.The main reason is that overall, Home teams are having their best season since at least 1995 (when records began), with the results for road teams playing on short rest (two or fewer days) against opponents who won their last game also an outlier.

The Overs on High Totals System is also struggling this season, with an ROI of -14.1%. While the number of points being scored per game is the highest since the 1969-70 season, the market appears to have adapted to the higher totals being set.

The NHL System started badly with losses in both October and November, but normal service was resumed in December and at the turn of the year, the system is 'officially' in profit, albeit by just 0.3%, but after trailing early on, this feels like a much bigger gain than it looks on paper.

Turning to football and while the Draw System in the EPL is currently down 5.33 units (from 29 selections) the similar Segunda División Draw System is currently up 7.89 units (from 78 selections) this season.

The World Cup Draw System was again profitable as I mentioned in my last post, up 24% overall and up 94% on games with no team odds-on at fair prices.

In the Bundeslayga, the laying systems continue to generate slow and steady profits and are currently up 4.30 units (ROI 1.49%), and that's about it for sports betting, at least for those systems detailed in the 'Sacred Manuscript'.

As I mentioned in my last post of 2022, my goal of 1,200 miles on foot proved too easy, and was initially bumped up to 2,000 miles before I belatedly realised that 2,022 miles made for a more interesting target, and the final total was exactly 2,023 miles.

Health will continue to be an area of focus in 2023, with my 'miles on foot' target 2,023 miles. I'm in a good routine and if I can stay healthy, this is again achievable. There's little point in trying to make money if your health isn't as good as you can possibly make it. I enjoy the time outside, and listening to podcasts certainly makes the longer walks go by easily. I love the time alone, with the mental benefits just as important as the physical. While exercise is of course good for you, for weight management it's mostly about the calories ingested as I have mentioned before.

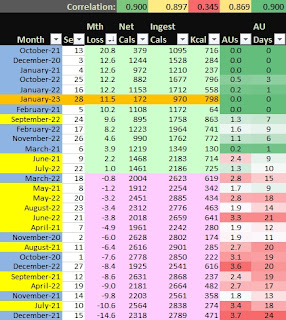

January is the 28th month I've been tracking these numbers, and while the net calories (ingested minus active calories burned) has a correlation of 90%, weight loss v ingested calories on its own has a correlation of 89.7%.

Alcohol totals and total days are also highly correlated to weight gain or loss, and one new year resolution is to cut down on 'junk' drinking - those days when I go out for a few beers just because a friend texts me. I'll save my beers for special occasions as much as possible but a Dry Veganuary should get the year off to a good start.

Unfortunately I have a propensity to gain weight if I don't watch my diet, with the scales measuring a gain of almost 11lbs after returning from a very enjoyable Xmas break with family. Overall I lost 19.2 pounds in 2022, so the goal in 2023 is to drop those 11 Xmas pounds in January, and another 10 through to the end of November when it all goes (literally), pear shaped again!

Stay disciplined and good luck in achieving all your goals in 2023.

No comments:

Post a Comment