Thanks to the GimmeTheDog site, it's once again an easy query that can verify the results for the NFL Small Road Dogs system on a Monday or Tuesday morning.

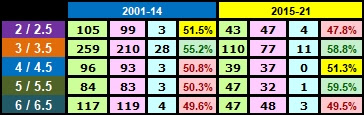

While the weekend just passed saw a small loss with the four selections going 2-2, the overall record for the season after ten weeks is a very solid 30-15 with the ROI over 30% and currently the highest for any season since the NFL went to a 32 team format in 2002:As you might suspect, I track the results of each specific line, and with five and a half seasons since the extra point rule change made prior to the 2015 season, I thought some of you might be interested in how that rule change has affected the point spreads.Prior to 2015, the profit was overall from the Road Dogs getting 3 and 3.5 points. The 'twos' were slightly profitable, while the 'fours' and 'fives' had a winning record, but not by enough to cover the vig.

Since 2015, the 'twos' have become losers, the 'threes' have become even more profitable, the 'fours' are in the 'profitable but hardly worth bothering with' category, but the biggest difference is in the 'fives' where the winning percentage is up hugely to 59.5%.

Five has become a pivotal number given that a team scoring a touchdown to lead by five is now incentivised to go for two points and lead by seven (rather than six) while similarly a team scoring a touchdown to come within five should go for two to reduce the deficit to a field goal rather than four points. Wins by five points have jumped as shown in this graphic from covers.com:Another comment from schnakenpopanz who pointed me to the gimmethedog site, writing:

Hello again, thx for the citation of my comment. Another part which is very interesting to me: The direct influence of officiating in the NBA this season. As mentioned here: https://www.msn.com/en-us/sports/nba/nba-rule-changes-2021-explained-referees-will-no-longer-reward-abnormal-moves-from-foul-hunting-stars/ar-AAPaKRaHow does this translate to the betting market and odds/lines/totals? If the lines of gimmethedog are correct. Blindly betting unders are 120-76. 2020 over was 581-575 for Overs. 2019 575-543 for Overs. So the Market AND the bookies hasn't transformed yet to these changes. The totals are very inefficient. A 60% edge is very unusual.

At the time of writing, blindly backing Unders this season has a 125-82 (60.4%) record with two pushes, but there are signs the market / bookies are adapting.

The NBA season has been in play for four weeks now, and the average total has steadily declined. In week one, the total was set at an average of 223.06 points, declining by week to 219.47, 216.05 and 215.4. We can be pretty certain the season will not end with Unders showing a 60.4% record! Over a 1,080 game regular season plus playoff games, a 60% edge would indeed be very unusual.

Tesla has been in the news again this month, with CEO Elon Musk selling (so far) a mere $6.9 billion of Tesla stock. That the stock is only down 5.3% this month is perhaps a good sign for the long term, and a modest drop following its incredible 43.6% jump in October.

There's also the small issue of the company being sued for a rather reckless Tweet from Musk back in August 2018, an event I remember well. At the time I was rather ill in hospital, although not as ill as my room neighbour who had just days to live and whose time was spent saying his farewells to friends and family, a rather depressing experience for me, as it no doubt was for him. It was all very well pulling curtains around his bed, but I couldn't help but overhear every conversation, however hushed.

Anyway, I remember the Tweet, and in particular the frustration that I wasn't able to trade the stock that day, but in the end my indisposition was a blessing in disguise.The price of 420 was a 33% premium on what I'd paid for them in 2017, and had I been in a position to do so, I may well have sold at that point in time. At the start of August I was in the red, but after Q2 earnings and then the infamous Tweet, they were about 20% up. They fell back over the next few days, and by the time I was in front of a computer again, the moment had passed.

At the time of writing the gains are currently well into six figures and my illness was very well timed. Who says there is no god?

Taking a 20% profit would have been quite upsetting to look back on given today's percentage:

Finally, I have finished reading "Trillions - How a Band of Wall Street Renegades Invented the Index Fund and Changed Finance Forever" by Robin Wigglesworth, and a very interesting read it was. It will now be passed on to my son who also likes such books. Put it on your Xmas List if you like books about finance and investment.

No comments:

Post a Comment