I postulated yesterday that when a Big 6 team are playing, Pinnacle know there will be a lot of interest, and have started to increase the over-round.

This did seem a reasonable observation, given that many of the games with the higher over-rounds had one team at short-odds, but having researched further, this doesn't explain why this season is different to previous seasons. Short priced odds-on favourites are nothing new, and a match between Tottenham Hotspur and AFC Bournemouth in October 2017 actually has the lowest recent over-round 101.2%, so that's no excuse.

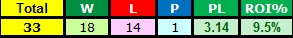

Going back to the 2015-16 season, only 40 matches (of 1,260) had an over-round above 102.5%, and 35 of these featured a Big 6 team playing a Little 14 opponent. Four were all-Little 14 games and one was a Big 6 match.

Here's the thing - all but five of these 40 matches were played since April 2018.

Something has changed, and the evidence would suggest that it's deliberate.

A season finale game in May 2016 was the first of the five exceptions, and the second was also an end of season game in May 2017. Both featured Manchester United.

The other three were in August, September and October of 2017, and then none until April this year; the lull before the storm.

Again, Pinnacle's decision to elevate the over-rounds in certain matches is fair enough. Non-monopoly businesses can charge what they want, and can choose which customers to do business with for that matter, and if the customer doesn't like the terms, then they are free to take their business elsewhere.

The impact of over-rounds is not understood by many bettors, and books tend not to shout about their margins, so it's unlikely that too many people have noticed this yet.

That books got away with over-rounds in excess of 112% in football for many years, and still do in some horse races, is a good indicator that the average customer is not sharp. They either see betting as a hobby and care little that they lose money, or they are irrationally exuberant. Caveat emptor.

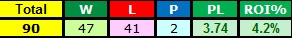

There is good news though. Of the 40 matches discussed above, Bet365 had a lower over-round in 15 of the highest 17, and in 25 of the 40. It's good to have options.