One hedge fund manager thinks so, but 'bad sports bettors' is a loosely defined term

by Jeff Edelstein

Thanos: Supervillian capable of wiping out half the world with the snap of his fingers.

Chanos: Super hedge fund manager capable of boosting the stock price of DraftKings while simultaneously ticking off nearly 100% of the sports betting public.

So yeah: Jim Chanos is a longtime, soon-to-retire, and famed — he called Enron going belly up — hedge fund manager. His specialty is, and remains, short-selling.

And DraftKings was in his crosshairs. He started shorting the company in May of 2021, according to a Financial Times article. But then this past July — and after taking a $10 million profit — Chanos dramatically shifted his position. The man who made a living betting against companies turned bullish on DraftKings — and on sports betting companies in general.

“The betting numbers have continued to be strong in the U.S., stronger than we thought they’d be,” he told the Financial Times. “The thing that we underestimated — that I think is going to be a benefit for all these companies for a while anyway — is what bad bettors the U.S. gamblers are.”

Ooof. Snap.

Parlay away

When it comes to “bad” betting, Chanos may have a point. A look at the volume of parlay wagering, for instance, paints a picture of Americans who aren’t exactly looking for +EV opportunities on their betting apps.

Now to be clear, most states don’t break down parlay numbers. But those numbers that are available say plenty.

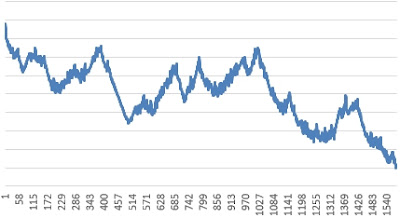

In Colorado this past October, 21.1% of money wagered at sports betting sites was on parlays. That’s up from 17.4% the previous year. Same for September, from 16.6% in 2022 to 19.3% in 2023.

Indiana? A similar story. More than 33% of handle in October 2023 was on parlays, up from 28.3% a year earlier. September’s numbers were close to those, 30.4% vs. 28.4%.

And make no mistake — more parlays equals more money for the sportsbooks. Overall hold percentage, according to the Financial Times article, is around 9% across American sportsbooks, up from 6% or so when PASPA was still the law of the land.

Or take this nugget from New Jersey, as highlighted by ESPN’s David Purdum: New Jersey bettors, through November of this year, wagered more than $2.5 billion on parlays — and the books won more than $486 million on those bets, for a hold of (avert your eyes) nearly 19%.

So of course — of course! — Americans are bad bettors, just like Chanos says.

Right?

Well, it depends on what your definition of “bad” is. Also, of “bettors.”

Terrible, just terrible

“Are Americans bad bettors? Right now, probably.”

That’s Jeff Benson, the director of sportsbook operations for Circa Sportsbook, which, since its inception in 2019, has been the North Star for the sharp set.

As to the why?

“I think many people nowadays have the ‘bet a little to win a lot’ mentality, while viewing sports betting as more of an entertainment product,” he said.

And that, right there, is a major dividing line between how people — both inside and outside the industry — view sports betting. Is it a serious income-generating endeavor? Is it a fun and inexpensive hobby? Is it somewhere in-between? Is it both? Is it neither?

“What even is a bad bettor?” wonders Alun Bowden, senior vice president for strategic insight at Eilers & Krejcik Gaming. “It’s a silly concept. Are slot users worse gamblers than blackjack losers? Is losing 5% good and 9% bad? It’s an insane way to look at this.”

Bowden thinks trying to bridge this divide between serious bettors and 14-leg single-game parlay wish-upon-a-star-ers is better left to the philosophers.

“You can’t frame gambling utility and entertainment from the perspective of a winning, +EV bettor,” Bowden said. “It’s like the Wittgenstein thing of talking to a lion. You just don’t understand each other because your frames of reference are so different.”

And if the lion, in this case, is the +EV bettor?

“America is a nation of horrible gamblers — ignorant of the odds, ignorant of the science, ignorant of the math. They always have been,” said Capt. Jack Andrews, a professional gambler for a quarter-century and co-owner of Unabated, which seeks to educate sports bettors.

“If Jim Chanos didn’t realize that until just recently, then he missed Atlantic City in 1978, Mississippi in the early ’90s where they couldn’t build the casinos fast enough to meet the demand, Foxwoods and Mohegan Sun in the mid-’90s where they literally couldn’t count the money fast enough and had to resort to weighing it rather than counting it. All fueled by bad gamblers.

“Here’s the thing,” Andrews continued. “The richest nation in the world, the nation with the most discretionary spend, combined with a nation that believes they can make something out of nothing, anytime they want. It’s a toxic recipe.”

And while that “toxic recipe” can mean recreational gamblers will lose in the long run by making bad betting choices, Andrews also thinks it’s to the long-term detriment of the sportsbooks themselves.

“Bad gamblers are not sustainable gamblers,” he offered. “Chanos and the bag holders of gaming stocks all think there is an unending supply of bad gamblers in the U.S. However, the ghosts of A.C. and Tunica show us that despite being bad with money, when Americans have no money they gamble less and they gamble more infrequently. They go from wagering $1,000 a week on a variety of games to wagering $50 a week on a variety of moonshot SGPs.”

To the moon!

“Americans do — and have always — liked the longshot of a little risk and a lot of reward. But it does not mean they are bad bettors,” said Las Vegas-based consultant Brendan Bussmann of B Global Advisors. “It just means they look at the opportunity differently and that will continue to evolve.”

Adam Levitan is one of the founders of Establish The Run, a site dedicated to fantasy sports, but he sees the same thing as Bussmann.

“If everyone just bet straight major market sides and totals, close to the start of games, and simply shopped two or three books for the best price every time, they’d only lose the juice. Their win/loss record would be close to even,” he said.

If you sense a “but” coming …

“But the overwhelming majority of bettors don’t want to do that. Because it’s not fun. So they bet parlays and SGPs and gimmicks and other bets the books shove down their throats,” he said. “Bets that they’ll lose 5 percent, 10 percent, 20 percent in the long term. And that’s fine, not everyone is trying to profit. Some people are just trying to have fun.”

Tock, tick

So why here, why now? Why have American sports bettors embraced the moonshot? Connor Allen, the sports betting manager for 4for4 Fantasy Football, has a theory.

“I think a lot of this coincides with the rise of certain social media channels glorifying the idea of ‘get rich quick.’ TikTok, Reels, Twitter channels are oftentimes focused on making money quickly, which inevitably [in the sports betting world] increases the sportsbooks’ hold, because they are taking bets that have a much lower chance of hitting,” Allen said. “Even personally, if I tweet out a bet that is -110 with great reasoning vs. a fun parlay that is 50-to-1 or something, the 50-to-1 parlay gets significantly more engagement. I think that’s representative of a lot of the U.S. betting market.”

Ryan Sigdahl, an analyst at Craig-Hallum Capital Group, wholeheartedly agrees with Allen.

“Americans are drawn to low-probability-but-high-potential-payout bets,” he said. “It’s why the lottery is so popular. Same thing for why Americans love sports-betting parlays. Small dollars bet to get high entertainment, and the sportsbooks are able to hold a higher theoretical win rate. Both player and house are happy. Win-win.”

Sustainable?

The big question — at least for the sportsbooks — then becomes whether this a sustainable way to run a business. Is Chanos correct in thinking the hold percentage will remain in the 10% range instead of the 5% range?

“I think it’s sustainable, as the recreational bettor loves a longshot and doesn’t bet enough to care that they lose a few bucks,” Sigdahl said. “The entertainment value is higher.”

Bussmann isn’t sure.

“The market continues to evolve,” he said, noting America’s newfound love of the parlay. “I think we need to see what all settles in before we can wrap up the American bettor in a pretty package.”

Robert Walker spent a career managing sportsbooks such as the Stardust and MGM Mirage. He thinks it’s too early to pigeonhole American sports bettors and to make grand pronouncements about future hold percentages.

“It’s very early in the game,” Walker said. “I would expect the hold percentage to level off — or even decrease — as novice players become a little more sophisticated. I think the Nevada model — and I’m very biased — is an illustration of that.”

Of course, Walker’s assessment has a major unknown: Will America’s sports bettors wise up? Do they even want to?

“A little education goes a long way,” Capt. Jack Andrews offered. “Shop for the best price before you bet and you likely cut the house edge in half. Look for news related to the game you want to bet and you’ll likely cut it in half again. Consult with other bettors to see what you might be missing and it’s halved again. Use tools and resources to identify good bets from bad, and that house edge approaches zero or swings in your favor.”

Simple, right?

“I think we are still in the first inning and consumers are nowhere near educated yet, but once that comes — timing to be determined — then maybe you’ll see a more price-sensitive individual,” said Benson, Circa’s sportsbook manager.

Sigdahl, for one, isn’t holding his breath for a Great Awakening in the sports betting world.

“The same reason you see people betting the middle of the craps table versus only playing the pass line with odds behind it,” he said. “The odds are materially worse, but [there’s] potential for bigger payouts” and the sense of fun trumps the math.

Andrews still holds out hope that for bettors, brains will win out over empty wallets.

“America was late to this party of legalized betting,” he said. “If we take the cue from other countries we’ll find that bettor education leads to a more balanced approach to betting. There are still plenty of bad bettors in the UK, Australia, and other countries which have been betting for years. However, bettors in those countries have realized that all that glitters isn’t gold in sports betting. It’s a more moderate spend.

“I think a lot of bettors will slowly evolve through attrition to be smarter bettors than they are now.”

Jeff is a veteran journalist, working as a columnist for The Trentonian newspaper in Trenton, NJ for a number of years. He's also an avid sports bettor and DFS player. He can be reached at jedelstein@bettercollective.com.