I was wondering why my hit count had dramatically increased lately (1400+ hits over the last two days) and in part, it was because of my recent post called Make Or Take aka "Can't Be Arsed", which appears to have been linked to on the FTS forum, frequented by a number of "Lay The Draw" aficionados. Despite being only two days old, the post is already in my top ten all-time. Unfortunately I can't read the comments over there as I am not a member, but it would be interesting to know what the general feeling was about my post. I can be a little provocative at times - just ask my sisters!

In contrast to the XX Draw selections, the Value selections had a poor weekend, dropping 13.78 points from 69 bets. La Liga was the worst of the leagues with more than half the points being lost here, (I'm beginning to hate La Liga) while Serie A was the best, up a miserly 1.04 points. There are clearly a few wrinkles still to work out with these selections, for a start 69 bets is far too many, and for the third round in a row, not a single Under 2.5 goals selection was found in France, while in Germany, when value is found, which is less often than France, it is currently always on the Under 2.5 goals. I'm also suspecting that the system may work better in the more competitive leagues rather than in La Liga and the EPL where the top two and top three teams respectively are almost certain before the season starts. France right now has five teams within two points of the lead and Italy, albeit after only four rounds, currently has no less than eight teams within one point of the lead! The Paris St Germain experiment could turn Le Ligue into a similarly boring one, but Olympique Lyonnais have been punching above their weight for a while, so perhaps not.

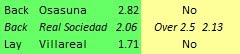

Six European games between rated teams this week, with the first games tonight. I see little value in the Bayern Munich v Manchester City match, with my prices close to the market's, although Under 2.5 goals is value at 2.16 versus my 1.88. Napoli (v Villareal) are a value lay at 1.75 (I have them at 2.0) and again, Unders is slight value at 1.85 (my odds are 1.69). As usual with these European games, there is little data to go on, so don't be putting your mortgage on any of them.

Now back to draws, and Griff stopped by to say:

Just wanted to give you a update on my own draw system. It's just based on the EPL so far this season: Strike rate 56.25% ROI 97.31%, and the back test over the past 3 seaons including also this season so far: Total matches 301, Strike Rate 36.88%, ROI: 31.37%.

Not too shabby. From January, when I first started recording the prices for these selections, the numbers for me are currently:

Since tracking the results of these selections, and assuming an average price based on the numbers for each league since 2011 (rounding down, but close enough for these purposes) my numbers are:

An ROI of 31.7% after 300+ matches is quite remarkable. I have a couple of questions: 1) Are all your selections from the EPL? 2) What was your longest losing sequence? 3) Are your returns to level stakes? 4) What prices are you using?

Sadly, the idea that people would be happy to donate after a weekend of winning selections is apparently a non-starter, as I suspected it might be. Worth a try, but I think that if people aren't delighted enough after a weekend of four winning draws from five selections, (with only a 90th minute goal coming in the way of a 500-1 accumulator), to make a donation, then the idea is clearly doomed. If anyone wishes to receive these on a subscription basis, and I am told there are a few of you out there, please send me an e-mail: calciocassini @ aol.com It'll likely be a while before we do as well again as this past weekend though!