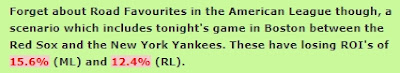

Back in 2008, my how the years have flown, I wrote a post titled Kelly Criterion in which I concluded that:

Most gamblers are probably best served by using a flat 2% of their bank per bet, since figuring edges in sports is, as mentioned earlier, very difficult.

It's a number that I have stuck pretty close to over the years and which has served me well. While I also suggested that "Increasing this to 3%, or occasionally 4% on an especially good play, is reasonable", a naturally conservative person such as myself gets a little uncomfortable with 1/25th of the bank at risk on any one bet!

And now thirteen years on, a similar, but more important calculation is when to retire and how lavishly do I spend in those early years of retirement before old age replaces living with "existing" and ultimately "existing" with "death."

Hopefully the "existing" period, if it occurs at all, will be brief, because it doesn't seem to offer too much in the "things to look forward to" category. [At 94, my Dad has this week moved out of the house he has lived in since 1955, close to 66 years, into a care home so excuse the depressing tone of this post so far.]

Anyway, back to those early years of retirement and the risk is that if you spend too much, you can be left with a shortfall in later years, but if you spend too little, you're not going to enjoy that retirement too much.

One frequently used rule of thumb for retirement spending is known as the 4% rule, or eponymously the Bengen Rule" after William P. Bengen, the retired financial adviser who first articulated the idea.It’s relatively simple: You add up all of your investments, and withdraw 4% of that total during your first year of retirement. In subsequent years, you adjust the amount you withdraw to account for inflation. By following this formula, you should have a very high probability of not outliving your money during a 30-year retirement according to the rule.

Another way of putting it is that your portfolio should be at least 25 times your annual expenses (plus taxes) in retirement.

Thirty years should be more enough for me. I've not led quite such a healthy lifestyle as my father, but these calculations really would be a lot simpler if one knew their date of death. I just depressed myself still further by using this stupid web site to calculate it, the result being: I've made a note in my diary with a reminder. It appears that another ten years is added on by going from drinking "twice a week" to "never" but that's not really "enjoying" retirement, and while another ten years would be nice, that's a high price to pay.

If I were to step up the drinking to daily, which doesn't seem unreasonable, and start smoking a pack a day (which would be idiotic), I can be done here in fewer than eight years!

However my wife will be returning from abroad next week, and the Cassini tradition of "Sober October" will be in full force (extra tough this year since it encompasses five weekends), and with "Dry January" also a thing and just around the corner, I shall have to recheck the predicted date of my passing next year.

Anyway, 10-K Diver is one of the accounts I follow on Twitter and they had a very interesting thread on the 4% Rule, the basics for which are: Suppose your retirement portfolio is a well-diversified basket of stocks, like the S&P 500.

Historically, such a basket of stocks has returned ~7% per year, plus ~2% in dividends. This is a total return of ~9%.

Assuming your annual expenses grow at ~2% per year (roughly the rate of inflation), your portfolio -- which is growing much faster at ~9% per year -- should have no trouble financing your expenses in perpetuity.

This means you'll never run out of money.

Here's the chart over 30 years with those numbers:

Which is all well and good, but as most readers will be aware, that 7% increase each year in the stock portfolio is about as consistent as our betting returns. Of course over the long-term they are profitable but profits are not consistent from season to season, and edges can disappear over time or overnight. The chart to the left shows the annual percentage increases and declines over the last 29 years with the average and median actually above the 7% mark which goes back to 1871, before the Football League was formed and just 10 years after Crystal Palace FC was formed. If you know, you know.

Anyway, I encourage you to read the thread in full for yourself, but 10-K Diver back-tested the 4% Rule going all the way back to 1871 and did a "what if Joe had retired in year...". The result was that Joe would have run out of money 13 times, most recently if he had retired in 1972 and lived to 2008, which is 36 years of retirement and not a duration I'm likely to experience.

The shortest period before going bust was 23 years, when a 1968 retiree would have gone bust in 1991.

Back to Bengen, and "based on his early research of actual stock returns and retirement scenarios over the past 75 years, Bengen found that retirees who draw down no more than 4.2 percent of their portfolio in the initial year, and adjust that amount every subsequent year for inflation, stand a great chance that their money will outlive them."

"A great chance" isn't certainty though, and unlike blowing a betting bank, it's a little harder to start again when you're in your 90s!

Given that the 4% rule fails sometimes, what's the solution?

10-K Diver then applied a 3% rule, i.e. the portfolio was 33.3 times that of the annual withdrawal. This time there were no failures, not one instance where this rate of spending would have ended in disaster.

So 10-K Diver took the idea a step further, and did some stress testing, a term some of you working in IT will be familiar with, and no, it doesn't refer to the weekly one-on-one with your manager. What this entailed was looking at the worst periods in history, so the worst one year period was 1930-31, the worst two years from 1929-31 and so on.

For our stress test, we'll assume that in our first year of retirement, stocks will deliver the worst 1-year return in history.

And in our first 2 years of retirement, they'll deliver the worst 2-year return in history.

And so on, for the first 20 years.

After that, he assumes the average 7% growth and allows for inflation to be at 4% rather than the original 2%. His findings:How well do our rules serve us in this stress test?

Well, the 4% rule runs out of money in 10 years.

The 3% rule runs out in 13 years.

The 2% rule runs out in 20 years.

The 1% rule never runs out.

Once again in life, the 2% rule looks likely to suit me perfectly. As 10-K Diver said in a reply "The 4% Rule will likely work most of the time. But it’s a bit too aggressive for me personally."

After all,

But when it comes to retirement, it's far better to overshoot than undershoot.

You do not want to run out of money in old age.

And even if it turns out you've been too conservative, that's not so bad. You get to do more charity, leave more money to your kids, etc.

The thread and replies also contain some interesting ideas, for example one was about maintaining a separate cash float to use instead of withdrawing from the portfolio after a bad year, which I like.

The bad news as I get ready to post this, is that I don't have a huge amount of time left, but the upside of that is that I do have more than enough to last me, and fewer years to spend it in than I thought, although my wife, kids and grandkids would probably prefer I leave at least something behind.