It's a rare League (Carabao) Cup Final profile for today's Manchester United v Newcastle United match with the Draw priced as third favourite.

Sunday, 26 February 2023

League Cup Final Profile

Berkshire Hathaway Annual Letter 2023

The annual letter from Warren Buffett to shareholders in Berkshire Hathaway Inc was published yesterday. It's always published on a Saturday, presumably to allow time for shareholders to read 144 pages of wit, humility, wisdom and numbers over the weekend.

One of my best individual holdings continues to be Warren Buffett's Berkshire Hathaway which I bought a little over two years ago and has quietly increased by a little over 37% in that time. It's not a jazzy holding, but it's a very solid one, and as regular readers will know, I'm a long time fan of Warren Buffett and his philosophy, although changes at the top for Berkshire Hathaway are unavoidable fairly soon with straight-talking vice-chairman Charlie Munger turning 99 yesterday.

The Class 'A' shares are currently priced at $461,705 and just one would be a rather significant percentage of my savings, but you only need to own a single 'A' or 'B' share to be eligible to attend the AGM in Omaha in person.

While I have no plans to do so, the 'B' share is currently priced at a rather more manageable $304.02 and the AGM is a popular event with around 40,000 investors attending in person, and hotel rooms in town priced at more than triple the usual rate.

It’s crucial to understand that stocks often trade at truly foolish prices, both high and low. “Efficient” markets exist only in textbooks. In truth, marketable stocks and bonds are baffling, their behavior usually understandable only in retrospect.

And this one on stock buybacks, which appears to be targeted at a certain US Senator:

The math isn’t complicated: When the share count goes down, your interest in our many businesses goes up. Every small bit helps if repurchases are made at value-accretive prices. Just as surely, when a company overpays for repurchases, the continuing shareholders lose. At such times, gains flow only to the selling shareholders and to the friendly, but expensive, investment banker who recommended the foolish purchases.

The key point here is the clarification that the repurchases need to be made at value-accretive prices. In October, it was reported that Meta, formerly known as Facebook, conducted a $45 billion buyback initiative at $300 a share. The only slight problem with this was that the stock dipped below $90 not long after!

The world is full of foolish gamblers, and they will not do as well as the patient investor.Patience can be learned. Having a long attention span and the ability to concentrate on one thing for a long time is a huge advantage.Don’t bail away in a sinking boat if you can swim to one that is seaworthy.There is no such thing as a 100% sure thing when investing. Thus, the use of leverage is dangerous. A string of wonderful numbers times zero will always equal zero. Don’t count on getting rich twice.You have to keep learning if you want to become a great investor. When the world changes, you must change.

Some good advice there for all of us.

Saturday, 25 February 2023

Sir Bernard Ingham

‘All right, Prime Minister,’ Ingham told her, ‘If that’s what you’re going to say I’m going to go outside and commit suicide.’ So she didn’t, and he didn’t.

My parents, I think jokingly, often said they would never forgive him for converting their normal - I use the term loosely - son into a 'football crazy' boy!

Sunday, 12 February 2023

Big Foot

With Superbowl LVII this weekend wrapping up the NFL season this evening, attention turns to baseball with Spring Training for the 2023 MLB season starting in less than three weeks. The Regular Season opens on March 29th, but significant changes to the 162 game schedule means that the usefulness of some of the data from previous seasons is, at best, questionable.

For comparison, the NBA currently has 30 teams (six divisions of five teams) and the NHL has four divisions of eight teams.

Friday, 3 February 2023

Points, SGPs and January

We had no luck for the small road 'dogs in the NFL Championship games last weekend, and as The Guardian summed up the Philadelphia Eagles v San Francisco 49ers game:

Well, we were all expecting a closer game, but the 49ers had ridiculously poor injury luck with their quarterbacks and far too many costly penalties, so we ended up with a rout instead. That happens sometimes.The Kansas City Chiefs v Cincinnati Bengals game was much closer, but we lost that one by a single point. C'est la vie. On to the Superbowl where the Eagles will play the Chiefs on Sunday week in Glendale, Arizona and wrap up what has been another profitable season in this sport. I am actually scheduled to fly to Phoenix for a work meeting later this month, but unfortunately a few days after the game so I shall miss out on the excitement that accompanies the event and my company will miss out on paying ridiculous sums of money for my hotel room.

ESPN had an interesting article covering the rise in interest in SGPs, Same Game Parlays which some of you may enjoy reading.

The days of placing a bet before a game and rooting for your team to cover the point spread are waning. The modern American betting market is full of player props, in-game betting and same-game parlays. Not even the long odds and the bookmakers' cushy margins are causing bettors to shy away from them. As we approach Super Bowl LVII, SGPs are as popular as ever.

This season, 46% of customers who bet on the NFL with a Kambi sportsbook placed a same-game parlay and 28% of all pre-game bets placed during the regular season were SGPs.

January is now in the books, and the EPL Draws had a profitable month (+1.19 units) with three winners from nine selections. In Spain's Segunda División, the similar Draw strategy had an even better month, with 19 selections generating 8 winners and 3.8 units of profit, while in the Bundesliga, the laying systems in the top division had a small profit, unfortunately more than offset by the loss in the Second Division resulting in a net loss of 2.21 units, although still (slightly) profitable overall on the season.

The US winter sports continued to be a challenge in the new year, with the NHL and NBA systems all taking losses overall, although the NBA Totals System managed a small profit in January. Unfortunately February has started with four successive losses, so any hopes that the tide may have turned have been rapidly squashed.

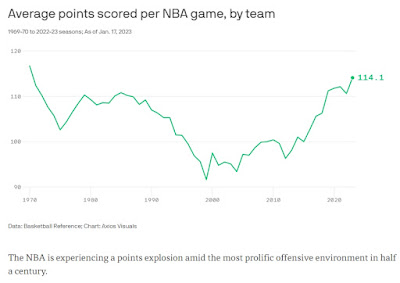

Why the NBA has changed so much this season is debatable but the game is changing fast as reported by Axios last month:

Now for the boring, personal stuff. The bigger picture for January was quite positive, with my spreadsheet showing a 2.73% overall gain, and I'm now back to within a few hundred pounds of where I was at the end of October! Tesla was up 40% after a dire few months, Bitcoin was up almost 47% and Lloyds Bank close to 18% and the only real negative was that my company stock price was down. It's annual review and bonus month in February, so hopefully any options and RSUs will be awarded at lower strike prices. Retirement is proving elusive.

While the 40% gain for Tesla sounds impressive, the price is still about 50% off its high. As Ben Carlson puts it:

Dry Veganuary was successful, and while I wasn't strictly vegan during the month, consuming a little fish and cheese, I did avoid any meat or poultry all month and this, combined with walking / running 227.9 miles, resulted in a weight loss of 16.8 lbs, and my weight is now back to where it last was 4,100 days ago! Not sure how long it will stay here given the upcoming travel and a certain amount of catching up on my social life after a quiet January, but rest assured, you will know in four week's time.

The correlation between weight gain / loss and calories ingested continues to be strong, with exercise making just a small difference. Consume fewer than 2,200 calories a day and I'll lose weight; more than that and I'll gain weight. And curiously the correlation between alcohol consumption and weight is strong too...