I received an email a couple of days ago from the good people at StatCounter whose free service I use to record the hits on this blog. It makes no difference to my life whether I get one hit a day or several hundred, but I do like my numbers and I do like them to be reasonably close to reality, so when they told me that they hadn't been tracking hits from mobile devices and offered an easy fix, I thought I'd make the change.

I wasn't expecting too much difference, but based on the first day's evidence, the increase is quite significant.

Admittedly a rather otiose fact, but that 531 total is my fifth highest ever, behind daily totals set when something dramatic has happened rather than on an average Autumn Friday. The blogger counter itself recorded exactly 700 hits yesterday:

which seems high based on the average last month, although the blog was fairly quiet for much of it. Anyway, as I said - all very meaningless but nice to know that someone is still reading. The total hits counter has been re-configured to use Blogger's (apparently more accurate) total.

Of course if my posts are all as boring as this one, the totals (or blog) won't be of interest to anyone!

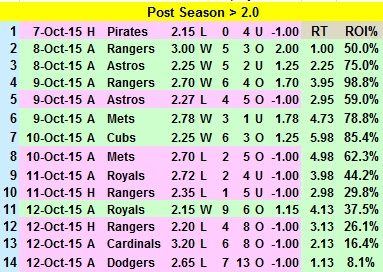

Another win for UMPO last night, as the Kansas City Royals became the first home 'dogs of the 2015 play-offs to triumph, beating Canada, aka the Toronto Blue Jays, by 5-0.

I was on at 2.2 although the 'official' price at the time of writing, which may well be adjusted, is a meagre 2.06. Tonight's price should be a lot longer, but the eyes of most Americans will be on the Cubs / Mets National League series which opens up four hours later. The Cubs will be road 'dogs in this one.