Three winners out of four last weekend for the 'Curse' / Unders selections, although with both rested teams winning their games, 'curse' may be a little too strong a word. Hopefully some of you were along for the ride.

Saturday, 28 January 2023

Cursed Profits and 17 Years of Benford

Saturday, 21 January 2023

NFL Playoffs; Rest and Grass

Some of you may recall the post from last October which looked at whether receiving a bye was a gift or a curse, but as a reminder it's that weekend of the year in the NFL where the number one seeds from the regular season resume after a couple of weeks off. The sample size of games where one team has 7 or more days of rest than their opponent is not large of course, just 45 games, but I noted then that:

Another major sport that rewards its top regular season performers with a bye week is the NFL, and here the data since 2002 shows that the rested team underperforms with just a 36.4% record ATS.

The two rested teams this weekend are the Philadelphia Eagles (v New York Giants) and Kansas City Chiefs (v Jacksonville Jaguars) who are giving about 7.5 points and 9 points respectively.

Both games are being played on grass, and while Unders is historically the bet on this surface in playoff games, in games where the home team has an extra week of rest, this has been the outcome in 64.3% of 28 such previous games.

The Eagles v Giants game is also a divisional game and by now, we should all know about opposing the favourite in such games.

Monday, 16 January 2023

Emotional Market

Although the sample size isn't huge, backing Away (or Road) underdogs in NFL playoff games is historically not the worst idea in the world with a 53.2% winning record against the spread and at least two winners in every season since the data begins in 2001.

The Miami Dolphins closed as consensus 14-point underdogs against the Buffalo Bills, making them the largest underdogs ever in a Wild Card game.

Since 2001 only two teams had been bigger playoff 'dogs, and while the value is usually on the smaller 'dogs, I took a chance that the market may have been wrong on this one.

ESPN continued:

The game attracted the lopsided action on Buffalo, with the bulk of the money on the heavily-favored Bills minus the points and on the money-line (-1,000).

The Dolphins covering was good for the sportsbooks as well as those of us feeling contrarian about this game and not getting emotional.

One more Wild Card game to go tonight - Dallas Cowboys (-3) at Tampa Bay Buccaneers and all five so far have gone Over.

Sunday, 15 January 2023

Superbowl Favourites in the Playoffs

With the NFL's Wild Card Weekend in progress, courtesy of SportsOddsHistory here are the fates of the Superbowl favourite at the start of the playoffs. I've converted the US odds to decimal, but the original is in the link above.

Tuesday, 10 January 2023

Milestones and Mountains

A rare comment on the blog earlier this year, from Hkibuzz who wrote:

One more year of the blog in the bag. Thank you for your entertaining and instructive posts, and all the best for 2023

I only managed 74 posts in 2022, which was down on the long term average but slightly up on the 2021 total, and the total number of posts all-time since 2008 is now closing in on 3,000.

The number of hits is also likely to reach a significant milestone this year with three million probable by June or July.

If I make it to March, and I have every intention of doing so, the coming of Spring will mark 15 full years of the blog. If this was a marriage, I'd be looking at a crystal gift to mark the occasion.

Thanks to Hkibuzz for the comment, which are always appreciated, and I'm always on the lookout for any general betting / investing blogs to add to the blog roll so if you have any recommendations please let me hear them.

The number seems to dwindle year by year, as the challenges of coming up with interesting topics as well as staying motivated when losing money prove insurmountable. It's easy to be enthusiastic about a project when things are going well, but a few losing weeks will soon change that.

I'm slightly annoyed that my bet on Georgia -13.5 wasn't matched in the College Football National Championship game last night given that TCU lost by 58 points, (7-65), but hindsight is a wonderful thing.

TCU were big outsiders to even make the College playoffs, not even quoted among the top 17 teams.

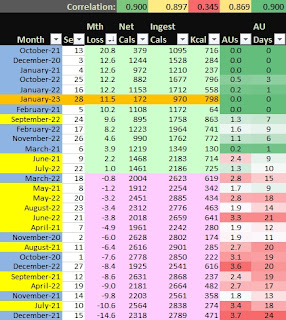

I wrote about the NFL Regular season yesterday, and in a further reminder that results will always vary slightly, the corresponding numbers from the Killer Sports database are:

Underdogs vs. spread:143-119-6 (54.6%)

Road teams vs. spread: 130-129-6 (50.2%)

Unders: 146-114-5 (56.2%)

Pretty close, and one interesting observation is that Unders had its best season ever (since 1989), and of these 34 seasons, three of the top four for Unders have occurred since 2017. The Unders on grass (as opposed to artifical turf) pitches was 59.4% and an incredible 69.6% (39-17-1) in the NFC this season.

In other (personal) news, with 900 miles covered on foot since the start of September, it's hard to believe that two years ago on this day, I was in a little discomfort after breaking my leg in three places. Yeah, yeah - don't go to those three places again...Anyway, I just quizzed my wife with "what happened two years ago today?" (she hates it when I do that), and when I told her, she said "oh yeah, remember when the ambulance guy thought you were my Dad?"

I'd actually erased that part of incident from my memory for some reason, but clearly it made an impression with Mrs. C and was actually quite funny. Clearly the gentleman in question had left his glasses at home that day.

Last summer's goal was to hike up Snowdon, something that I had long delayed after losing a friend in an accident there back in 1972.

The news wasn't delivered in the most compassionate way. I can still remember my Dad reading the newspaper at the breakfast table and, prompted by the Purley reference in the report, asking me: "Do you know a John Twyford?, presumably not imagining for a moment that I did.

After responding in the affirmative, adding that he went to the same youth club as myself, and asking why he would ask, he paused for a moment and then said "Well he's dead. Fell off a mountain." That's how we dealt with things in those days I suppose.

This year we're targeting Scafell Pike in early July and if the weather permits, Helvellyn, which I last ascended exactly 50 years ago, although I'm hoping for better weather this time around, and I might be more prepared.

Monday, 9 January 2023

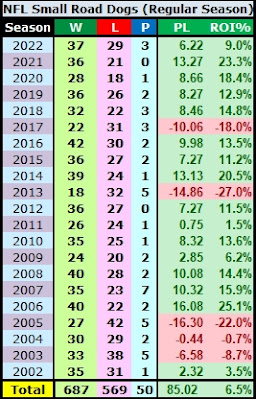

NFL 2022 Small Road Dogs

Tuesday, 3 January 2023

X-Axis and Tesla Woes

In my first post of 2023, I touched on a couple of topics that have subsequently become more relevant.

This was my first down year since I started tracking these things in 2009, with my net worth total declining by 11.6%. At my age, this number is all about investment performance, with income from employment pretty much irrelevant.

This is a topic covered by Nick Maggiulli today, accompanied by a nice chart illustrating my point rather neatly:

I'm at the extreme right of the x-axis above, and clearly while saving over 20% of my income doesn't hurt, how my investments perform is far more impactful to my net worth.Interestingly, Nick's year seems to have been very similar to mine, although he is far younger. In this article he writes:

In fact, 2022 was the first year ever where I saw a decrease in my net worth from the year prior. To be specific, my net worth dropped by 11% in 2022 though my portfolio was down over 20%. What prevented my net worth from declining by 20% like the rest of my portfolio did? My ability to save money to offset my investment losses.

As I mentioned in my post, a reasonably large percentage (about 20%) of my portfolio is made up of investments in my company, which performed relatively well last year, although my main retirement account was down almost 20%.

That's four consecutive mentions of 20%, make that five, which must be something of a record!

The second topic I mentioned was that of Tesla, and I suggested that:

"he [Elon Musk] seems to be having some kind of mid-life crisis and his political views, unpleasant to the majority of people, and certainly to his customer base, have likely reduced the demand for Tesla cars."

The stock ended the day down by 12.24% after the company:

"delivered fewer vehicles in 2022 than it initially targeted, capping a year during which the stock suffered its worst annual performance as demand appeared to soften and Covid-related production disruptions persisted."

Not the start to the new year I was hoping for, but a tremendous buying opportunity, or is the stock headed for under $100 shortly? Time will tell.

Ken Block

2023 hasn't started well with the terrible news that Ken Block was killed yesterday in a snowmobile accident in Utah at the age of just 55, leaving behind three children. Ken was more recently famous for his rally driving and stunt videos, but was a business partner of my wife's brothers founding DC Shoes in 1994, a venture that worked our rather nicely for them.

Monday, 2 January 2023

Eyeballs on 2023

2023 is not only the second consecutive year that is a harshad number and it is also an Eyeball Year since its binary representation only contains two zeroes and they are consecutive.

As for the year just gone, much of what I wrote in my review of 2020 a year ago remains true.My job isn't really work these days. It's all meetings and management and if I can do it full-time from home, and by full-time I often mean for two to three hours a day, then I might as well hang in there until the next bonus and stock options are doled out at least, which is next month. Were my job hacking away at a coal face, my attitude to retirement might be a little different.

Of course the stock market will crash at some point, but predictions have been out there for at least eleven years now, and if you'd moved to cash at that time, I'm pretty sure you wouldn't be too happy.

The stock market probably won’t give us “average” returns. Depending on the time frame you use the long run annualized return for U.S. stocks is something in the 8-10% range.

The strange thing about investing in stocks is any given year rarely gives you anything close to that range of returns.

In fact, going back to 1928 there has been one single year of returns that fell between 8% and 10% (1993 when the S&P 500 was up 9.97% in total on the year).

Most of the time the stock market is up big or down big on the year. From 1928-2022, 70% of all years have seen double-digit gains or losses.

A great example of how averages, at least in the short-term, are often not very useful.